- AUD/JPY picks up bids after bouncing off the key supports.

- One-month-old support line, 21-day EMA offer immediate downside barriers.

- Buyers may wait for a clear break of the 12-day-old resistance line.

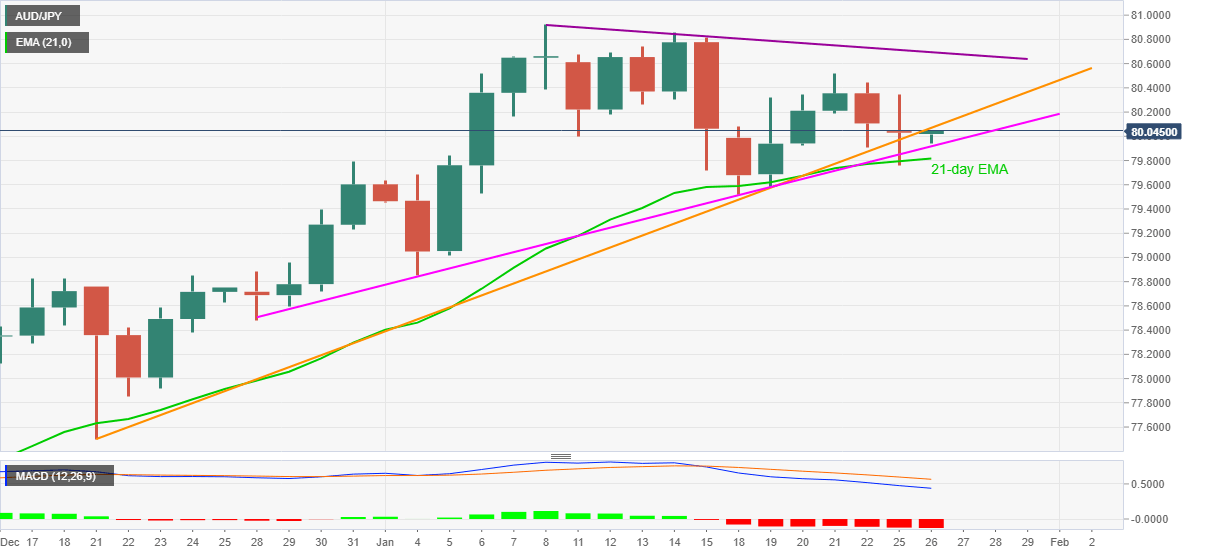

AUD/JPY picks up bids near 80.05 during the initial Asian trading on Tuesday. The quote dropped to the lowest in one week the previous day but couldn’t keep the downside momentum as the key support lines and 21-day EMA probed sellers.

Even so, bearish MACD and a gradual weakness since early January keep sellers hopeful.

As a result, AUD/JPY buyers will wait for a clear run-up beyond the 80.10 round-figure, also comprising an upward sloping trend line from December 21, 2020, to challenge the previous week’s top around 80.50.

However, a descending resistance line from January 08, currently around 80.70, followed by the monthly top of 80.92 and the 81.00 threshold, will be tough nuts to crack for the AUD/JPY bulls.

Meanwhile, 21-day EMA and an ascending trend line from December 28 test short-term AUD/JPY sellers around 79.90-80. Also acting as the support is the monthly low near 79.50.

Should the AUD/JPY prices stay weak past-79.50, mid-December tops near 78.80 will gain the market attention.

AUD/JPY daily chart

Trend: Pullback expected