- AUD/JPY wavers around the weekly top while struggling to extend rise from 79.60.

- A trend-reversal suggesting candlestick, failures to cross short-term resistance tease bear’s return.

AUD/JPY fades the upside momentum while easing to 80.25 during the early Asian session on Wednesday.

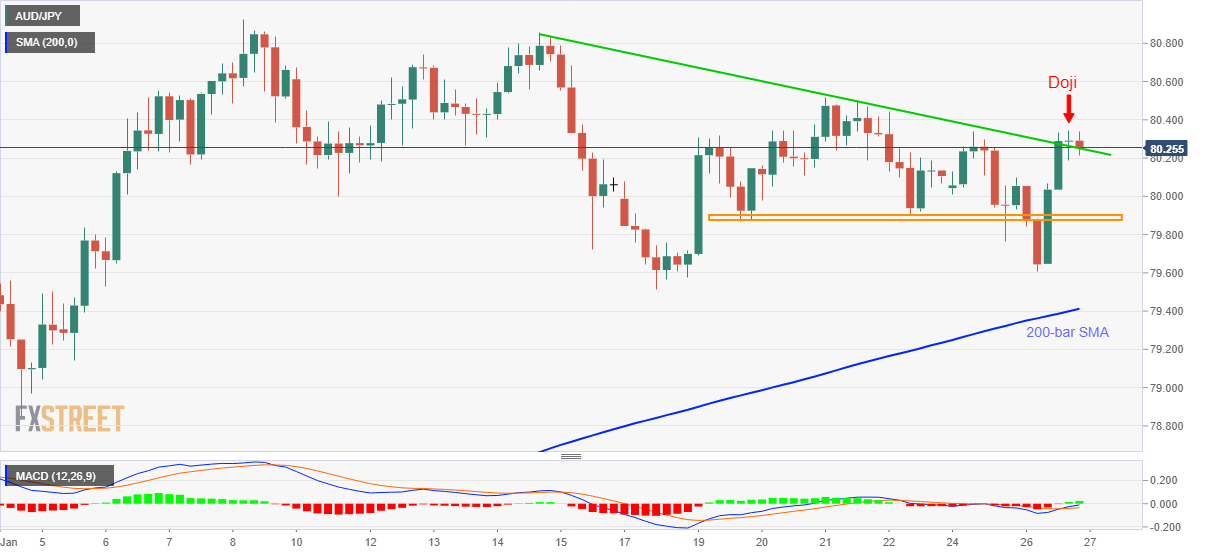

The pair refreshed weekly top the previous day but failed to provide a decisive break beyond a falling trend line resistance line from January 14. In doing so, the quote printed a Doji candlestick on the recent top while following the four-hour (4H) chart. As a result, AUD/JPY traders get cautious ahead of the key Australian Consumer Price Index (CPI) data for the fourth quarter (Q4).

Read: Australian Quarterly CPI Preview: Upside surprise could save the day for the AUD bulls

During the quote’s return, which is more likely considering the downbeat expectations from the scheduled data and challenging technical patterns, the one-week-old horizontal region near 79.90-85 will be the key.

Also likely to test the short-term AUD/JPY seller is the monthly low near 79.50 and the 200-bar SMA around 79.40.

Alternatively, surprisingly positive data can propel the quote to defy Doji while breaking the recent high near 80.35 and rise towards January 21 peak surrounding 80.50.

Though, highs marked during January 14 and the monthly top, respectively near 80.85 and 80.95, can test the AUD/JPY buyers afterward.

AUD/JPY four-hour chart

Trend: Pullback expected