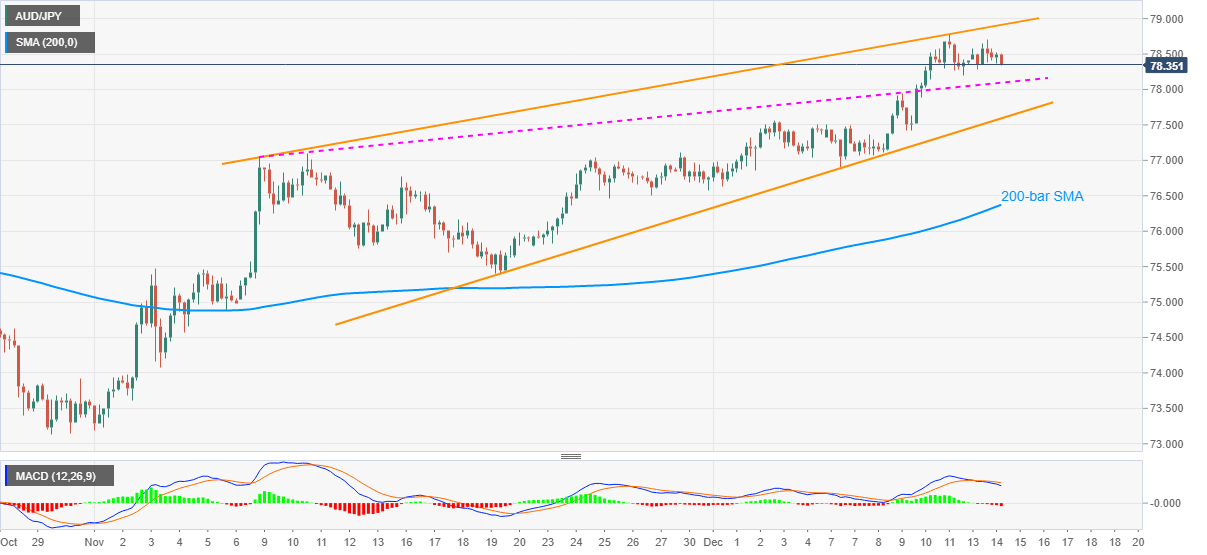

- AUD/JPY extends Friday’s U-turn from fresh high since April 2019.

- Bearish MACD, failures to bounce suggest pullback to previous resistance line from early November.

- 200-bar SMA adds filters to the downside, the 79.00 threshold can probe the bulls.

AUD/JPY remains depressed around 78.35 amid the early Tuesday morning in Asia. In doing so, the pair keeps the last week’s pullback from a multi-month high, after rising to the 20-month peak, inside a bearish chart pattern.

With the inability to recall the buyers, coupled with the bearish MACD, AUD/JPY is likely to revisit the previous resistance line stretched from November 09, at 78.09 now. However, the pair’s further downside will be challenged by the stated rising wedge’s support line, currently around 77.60.

If at all the AUD/JPY bears manage to dominate past-77.60, they can target a 200-bar SMA level of 76.37 as an intermediate halt ahead of eyeing the theoretical signals after confirming the rising wedge, November 04 low around 74.10.

Meanwhile, highs marked recently close to 78.70/80 will precede the late-April 2019 peak surrounding 79.00 to challenge the AUD/JPY buyers’ entries.

In a case where the quote manages to stay firmer above the 79.00 threshold, it can aim for February 2019 tops close to 79.80/85 before looking at the 80.00 psychological magnet.

AUD/JPY four-hour chart

Trend: Further weakness expected