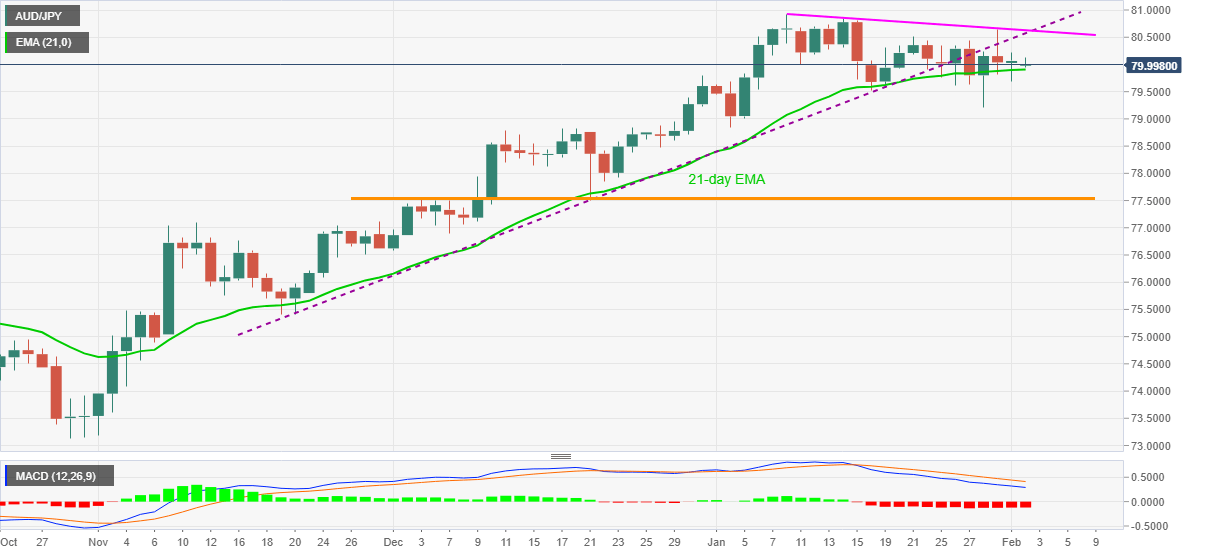

- AUD/JPY buyers catch a breather above 21-day EMA.

- Sustained break of ascending trend line from November 20, bearish MACD probe buyers.

- Monthly resistance line adds to the upside filter.

- RBA is likely to keep the monetary policy unchanged, comments on inflation, QE will be the key.

AUD/JPY drops to 80.03 during its latest pullback from an intraday high near 80.10 amid Tuesday’s Asian session. In doing so, the quote keeps its upside momentum beyond 21-day EMA while also staying below the previous key support line amid bearish MACD.

Other than the recent consolidation below the key resistance confluence comprising the previous support line and monthly falling trend line hurdle, cautious sentiment ahead of the Reserve Bank of Australia’s (RBA) monetary policy meeting also challenges the pair moves.

As a result, dovish comments from the RBA and/or hint for further Quantitative Easing (QE) will be watched to break the immediate EMA support, at 79.91 now. Following that, Thursday’s low near 79.20 and the early December tops surrounding 78.80 will be the key to watch.

In a case where the silver bears dominate past-78.80, a two-month-old horizontal area around 77.50 will be the key.

Alternatively, a confluence of a falling trend line from January 08 and earlier support from late-November, near 80.55-60 becomes a tough nut to crack for AUD/JPY buyers.

Should the quote rises past-80.60 on a daily closing, the previous month’s high around 80.90 and the 81.00 round-figure are less likely to stop the bulls.

AUD/JPY daily chart

Trend: Pullback expected