- AUD/JPY remains on the front foot near the monthly top despite disappointing Aussie data.

- Sellers will look for entry below the four-week-old rising trend line.

- March monthly high on the bulls’ radars beyond 50-day SMA.

AUD/JPY pays a little heed to disappointing Aussie data while taking the bids to 69.05 amid Tuesday’s Asian session.

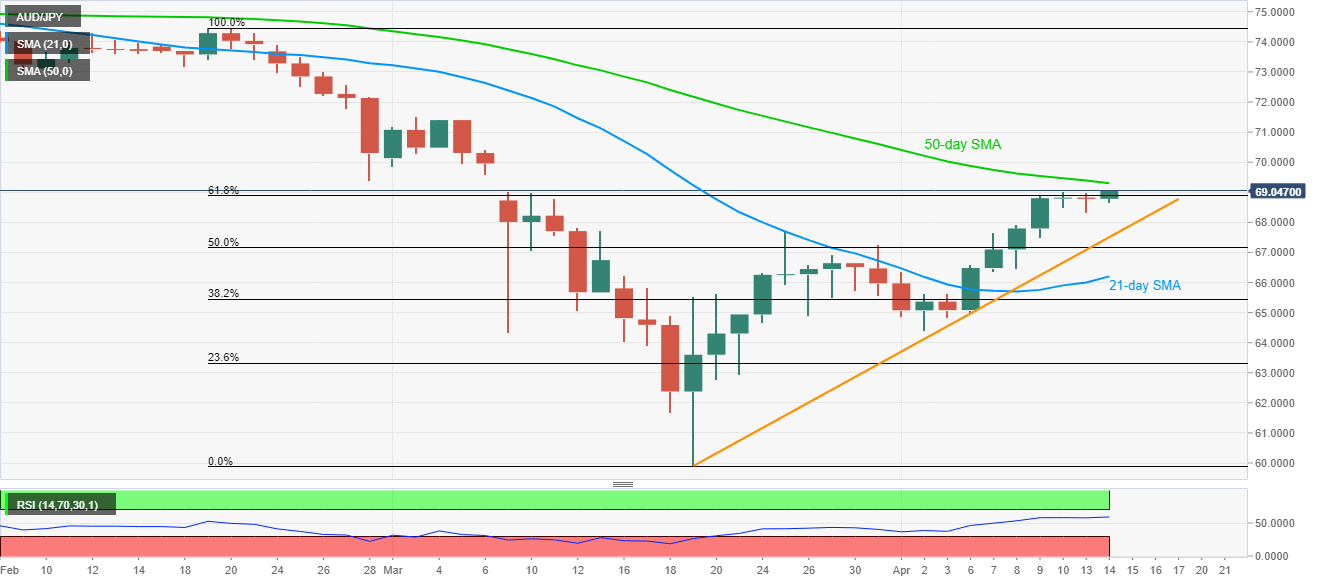

In doing so, the pair pierces 61.8% Fibonacci retracement of its fall from February 19 to March 19 while aiming to confront a 50-day SMA level of 69.30.

Should the pair’s run-up prevails beyond 69.30, 70.00 round-figure and March month high of 71.40 could lure the buyers.

March month Business Confidence and Business Conditions from the National Australia Bank (NAB) register downbeat figures of -66 and -21 versus -2 and 1 respective forecasts.

On the contrary, sellers are likely to wait for the clear break of an ascending trend line since March 19, currently at 67.50, for fresh entries.

In doing so, 50% Fibonacci retracement, around 67.15, will be on the bears’ target list ahead of 21-day SMA level of 66.20.

AUD/JPY daily chart

Trend: Bullish