- AUD/JPY running out of steam, eyes on bearish corrections.

- There are a number of downside structures to penetrate prior to a run at the trendline support.

AUD/JPY has been on a sensational run of late, dragged higher on the basis of sales of iron ore to China, huge Australian account surplus, lack of investment capital in the markets and highly irregular money flow.

To top it all off, global equities have been almost just as impressive as markets lap up the prospects of consumption and pent up demand as lockdown restrictions are lifted.

The following are a series of charts which demonstrate the AUD/JPYs technical picture and a potential bearish outlook as the rally wears thin.

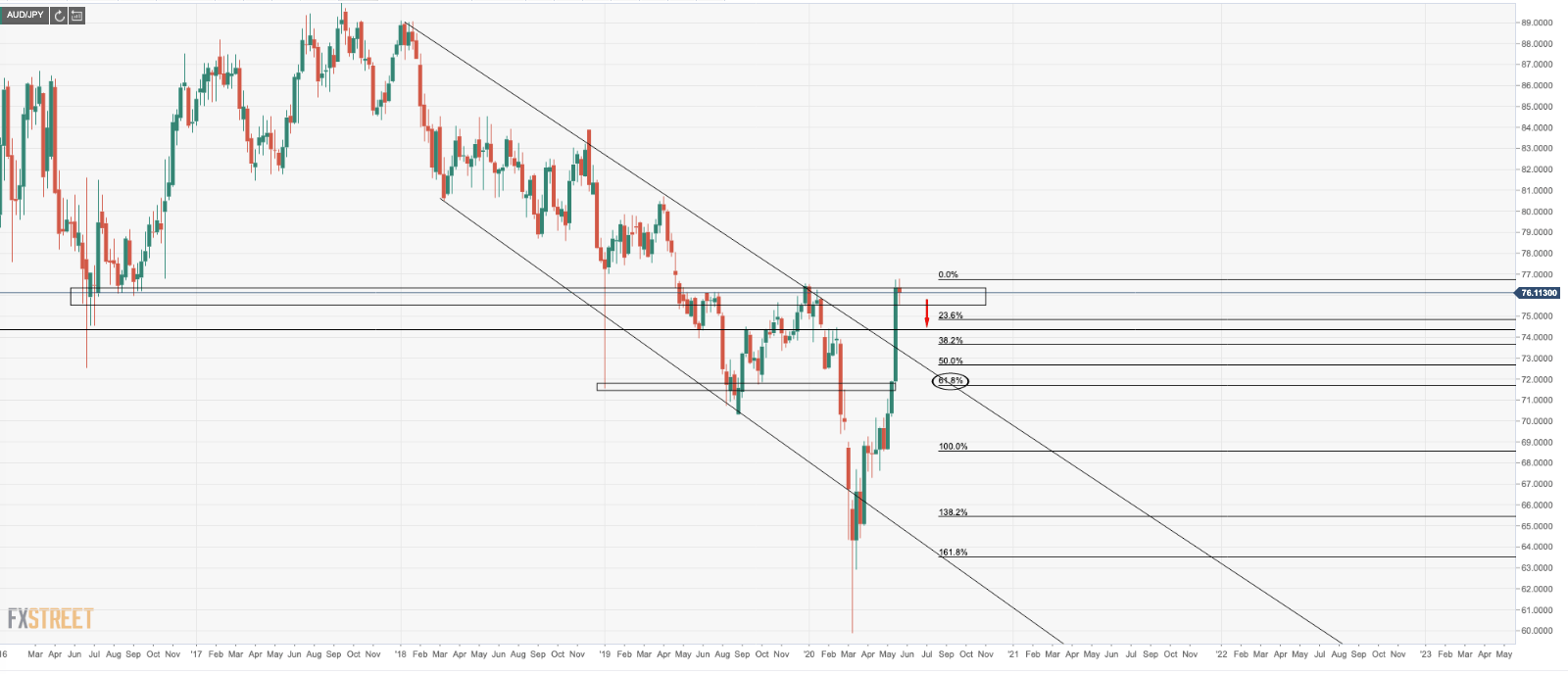

Weekly bearish channel corrupted by an outsized rally

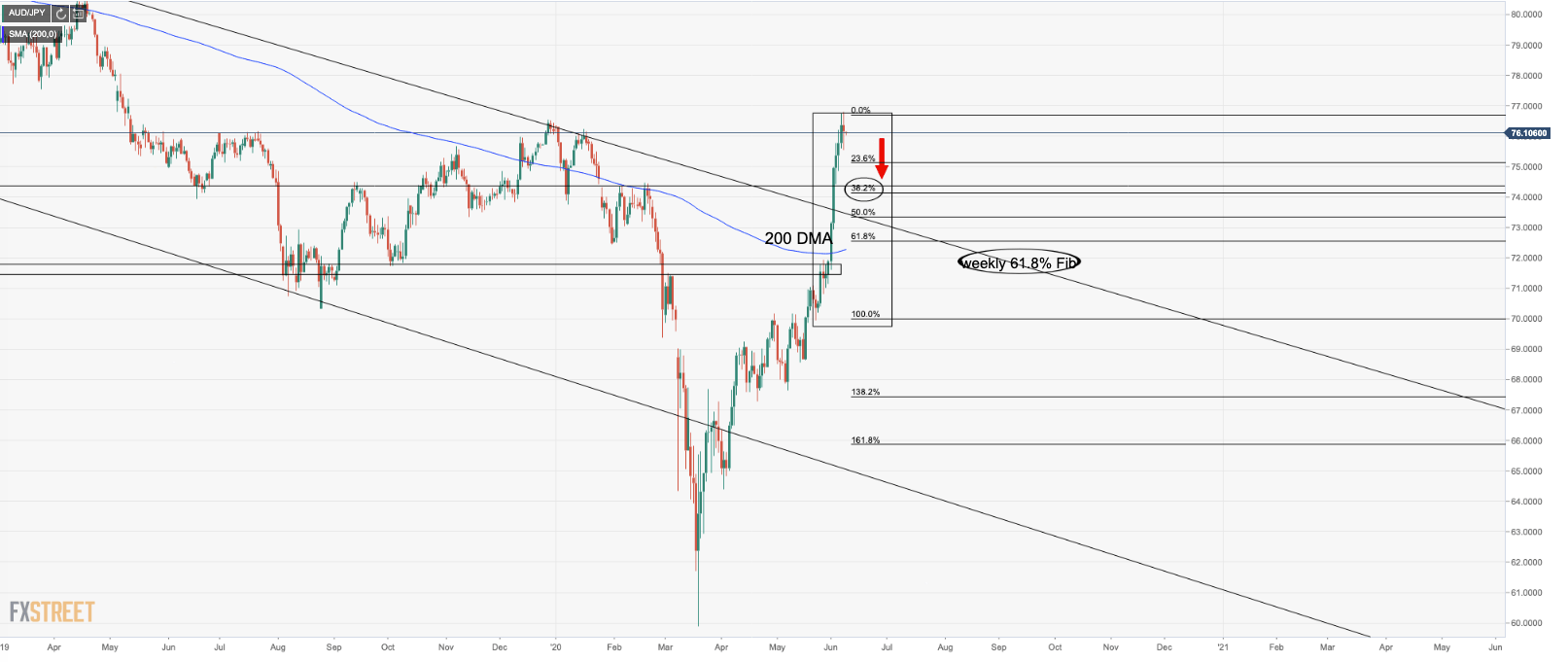

What goes up, must come down, 200 DMA in view

Looking left to support structure, 38.2% Fib correlation ahead of 61.8% and 200-day moving average correlation target to trendline support.

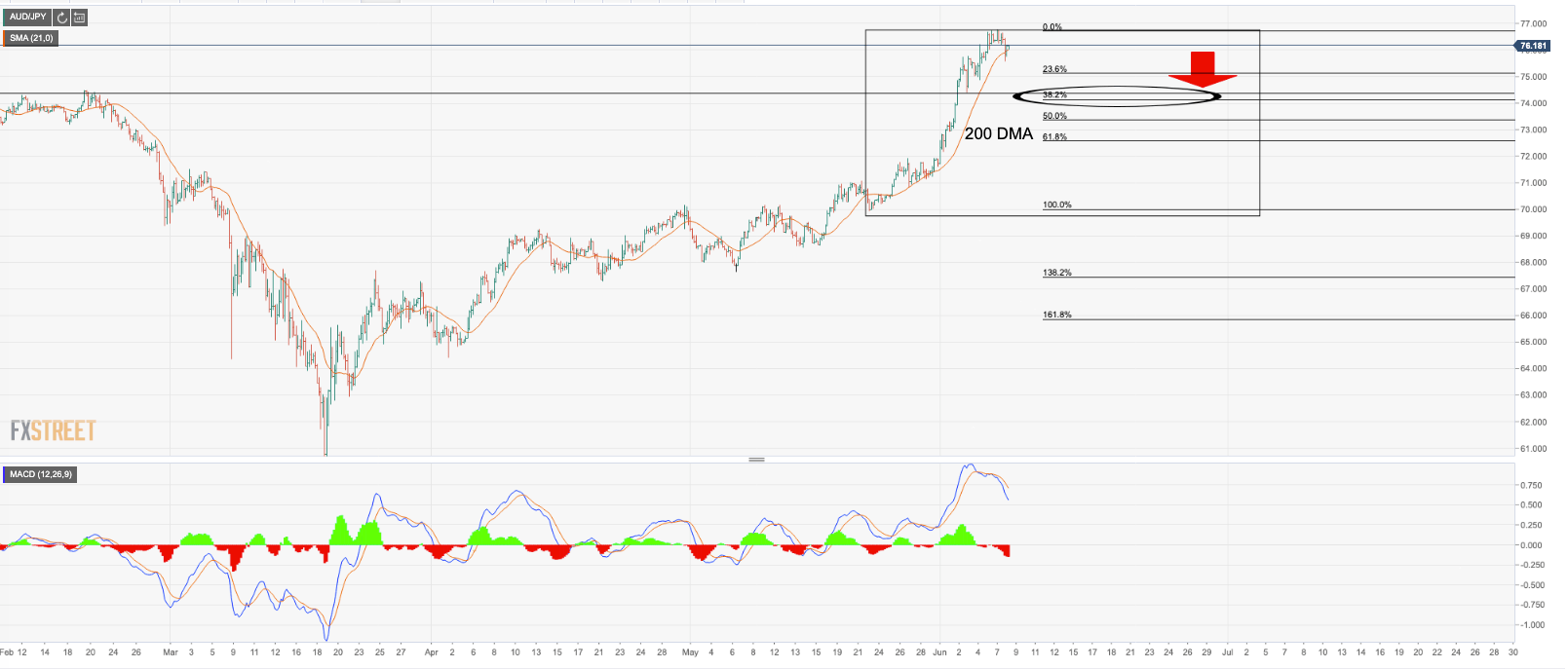

4HR MACD not confirming bearish conviction, yet

Ideally, price wants to be below the 21 moving average along with bearish MACD.