- AUD/JPY takes a U-turn from support-turned-resistance, extends losses.

- Multiple stops around 73.00 could question sellers ahead of 61.8% Fibonacci retracement support.

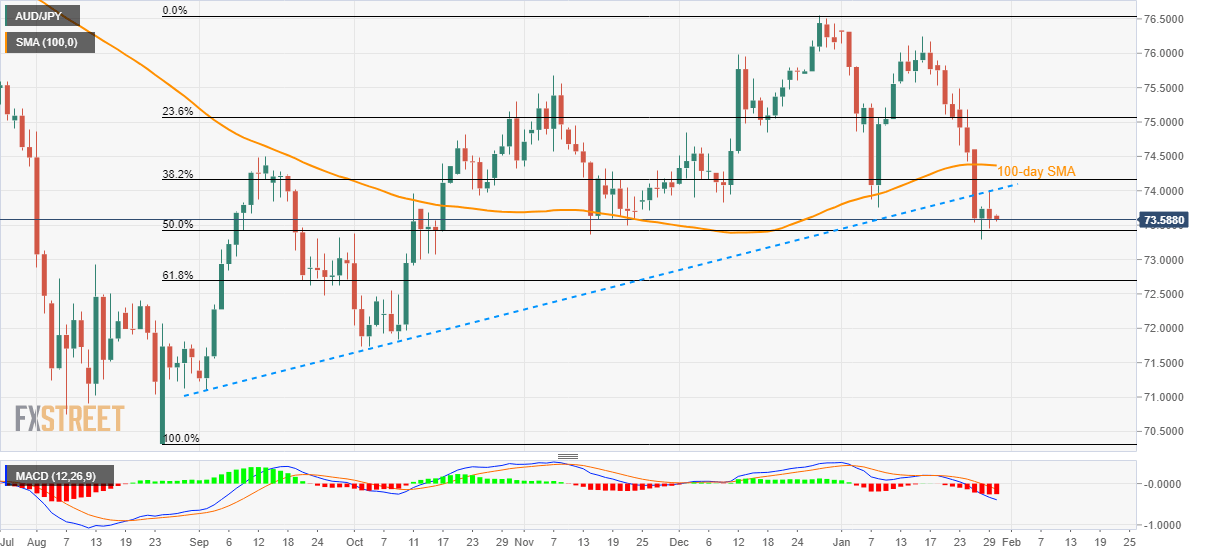

- 100-day SMA adds to the resistance.

Failure to cross the support-turned-resistance line keeps AUD/JPY weak while flashing 73.60 as a quote during Thursday’s Asian session.

The pair tried offering an upside break to the rising resistance line, the previous support, since early-September. Though, failure to break the same, coupled with bearish MACD, seems to direct the pair towards 50% Fibonacci retracement of its August-December 2019 upside.

Following the immediate rest-point around 73.40, multiple stops near 73.00 could challenge the sellers before pushing them to 61.8% Fibonacci retracement of 72.70.

During the pair’s further declines below 72.70, October 2019 low close to 71.75/70 will be on the bears’ radar.

Alternatively, an upside clearance of the support-turned-resistance, at 74.00 now, needs to cross a 100-day SMA level of 74.40 on a daily closing basis to regain buyers’ confidence.

With that, AUD/JPY prices can aim for 75.00 during further recovery.

AUD/JPY daily chart

Trend: Bearish