- AUD/JPY bounces off weekly low, remains below short-term key resistances.

- Bearish MACD counters oversold RSI conditions.

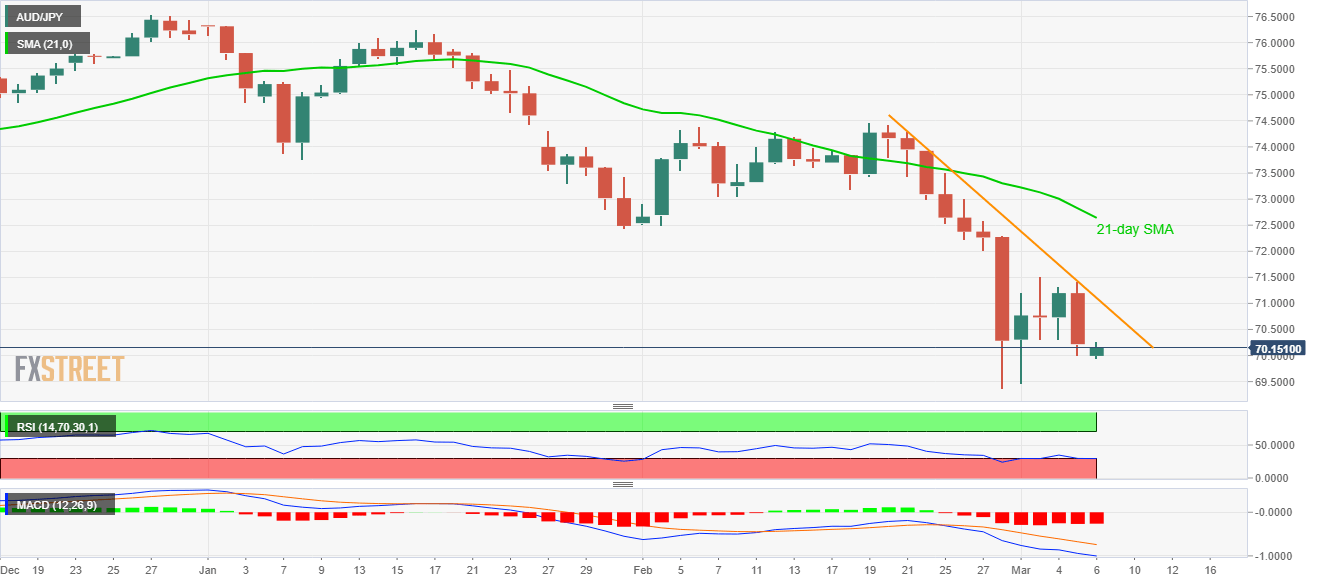

AUD/JPY bounces off weekly lows, mainly due to oversold RSI, to 70.20 by the press time of early Asian session on Friday. That said, the pair dropped heavily the previous day while also stays below even the short-term key resistances.

Given the bearish MACD signals confront oversold RSI-led bounce, the pair is less likely to hold its recent pullback much beyond the immediate resistances.

Among them, a downward sloping trend line from February 21, at 71.10, acts as the immediate resistance ahead of the early-February month low near 72.44 and 21-day SMA around 72.65.

If at all the bulls manage to cross 72.65 mark, the previous month top near 74.50 will be important to follow.

On the contrary, 70.00 can be considered as the closest support ahead of the recent multi-year low around 69.40.

AUD/JPY daily chart

Trend: Bearish