- AUD/JPY recovers from a three-day low of 75.45 after Aussie data.

- Australia’s NAB Business Confidence, Business Conditions print mixed results.

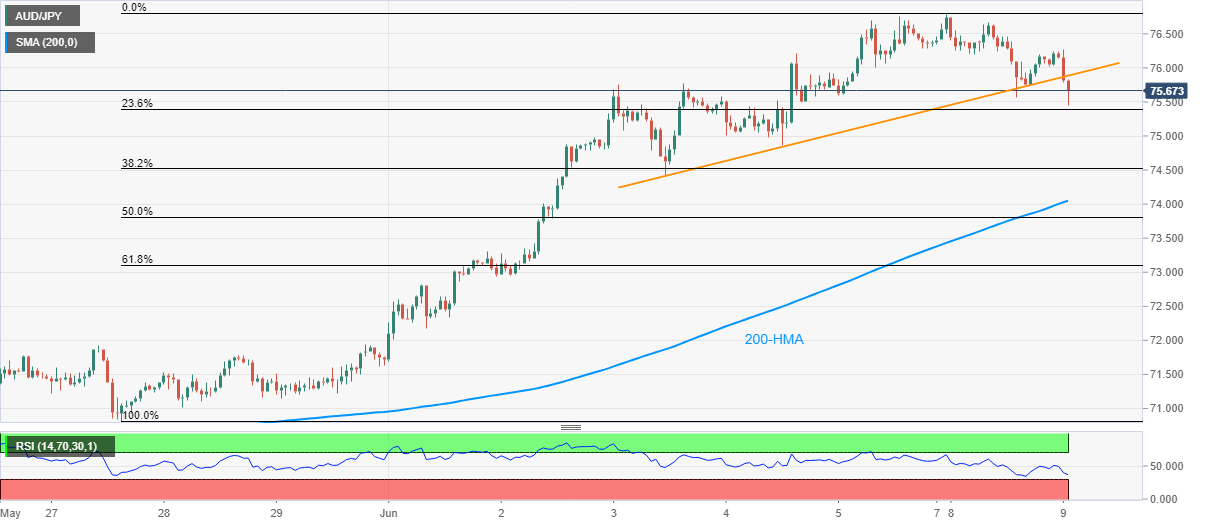

- 200-HMA on the bears’ radar, bulls may await a clear break above 77.00.

AUD/JPY bounces off intraday low to 75.70 after second-tier Aussie data published during Tuesday’s Asian session.

Australia’s NAB Business Confidence in May recovered from -32 to -20 but Business Conditions deteriorated further below -16 forecast to -24.

Read: NAB Business Confidence and Conditions bounce back

Even so, the pair’s break of an ascending trend line from last Wednesday keeps the sellers hopeful of attacking June 03 low near 74.40.

However, oversold RSI conditions might restrict the pair’s further downside around a 200-HMA level of 74.05.

On the contrary, buyers are likely to remain cautious unless the pair cross 77.00 round-figure. Though, an upside break of the recent high, also one-year high, near 76.75, can offer intermediate buying opportunities.

Should there be a clear rise past-77.00, the bull’s might not hesitate to aim for March 2019 low near 77.50/55.

AUD/JPY hourly chart

Trend: Further downside likely