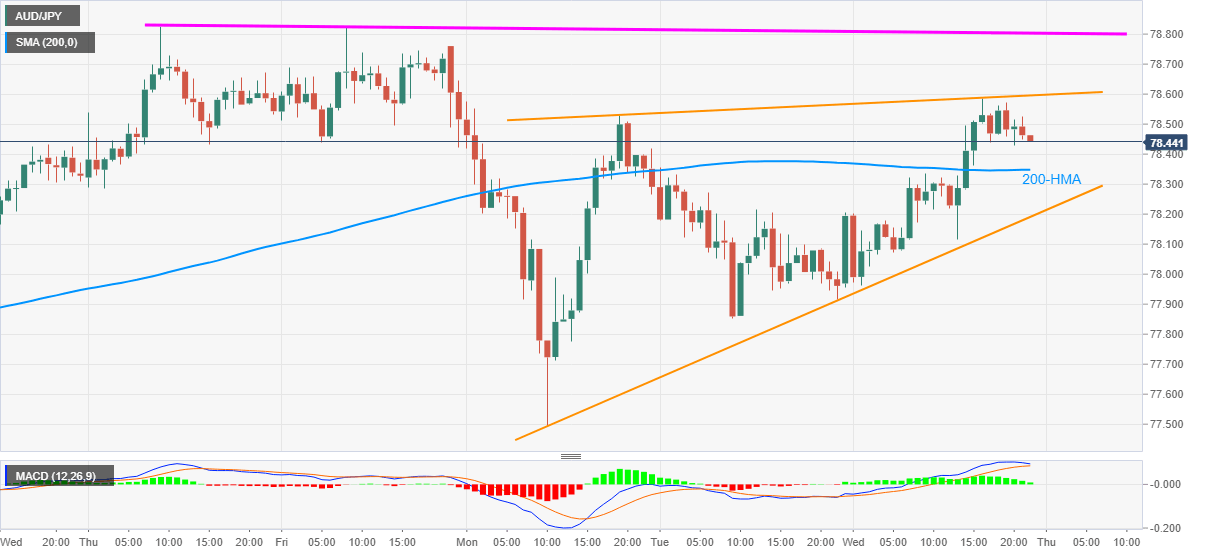

- AUD/JPY wavers in a 10-pip range above 78.40.

- Bullish MACD, sustained trading beyond 200-HMA probe sellers analyzing bearish chart pattern.

- One-week-old horizontal line adds to the upside barrier.

AUD/JPY eyes the lower end of the recent trading range between 78.42 and 78.53 during the initial Asian session on Thursday. The quote marked the heaviest gains in two weeks the previous day. Though, the rising wedge formation on the hourly chart (1H) becomes important to watch off-late.

It should, however, be noted that the sellers eyeing the bearish chart pattern will gain support on the break of 200-HMA, at 78.34 now.

While receding strength of the bullish MACD points toward increasing odds of 200-HMA break, a clear downside past-78.15 becomes necessary to confirm the rising wedge.

Following that, the recent low near 77.50 and the 77.00 round-figure can entertain the AUD/JPY sellers ahead of targeting the monthly low near 76.57.

Alternatively, an upside clearance of the stated pattern’s resistance line, at 78.60 now, will again challenge highs marked during last Thursday and Friday, close to 78.80.

Should the AUD/JPY bulls manage to cross 78.80, late April 2019 top near 78.95 and the 79.00 will be the key to observe.

AUD/JPY hourly chart

Trend: Pullback expected