- AUD/JPY falls in sync with risk-appetite amid global growth woes.

- Rising channel breakdown spotted on the hourly chart.

- Hourly RSI peeps into the oversold region, eyes on US GDP.

AUD/JPY, the fear gauge, tumbles in tandem with the risk appetite, as markets remain nervous amid devastating German Q2 GDP numbers and ahead of the US Q2 GDP report.

The cross also tracks the sell-off in the S&P 500 futures, which are down 0.80% around 3225, at the press time.

Besides the unfavorable fundamentals, the technical outlook on AUD/JPY also remains bearish, with the further downside likely on the cards.

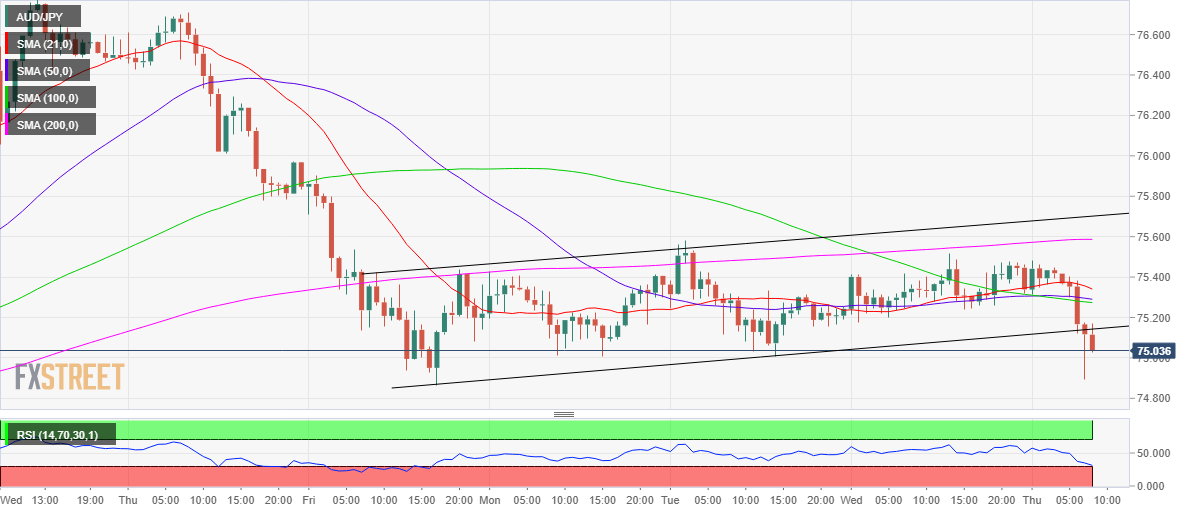

The pair has charted a classic rising channel breakdown on the hourly sticks, calling for a test of the pattern target of near 74.50.

Ahead of that level, the daily low of 74.89 could be tested. The hourly Relative Strength Index (RSI) hovers around the entry point of the oversold territory, at 30.31, backing the case for additional weakness.

Any pullback is likely to be short-lived and could face immediate hurdle at 75.14, the pattern support-turned-resistance.

Acceptance above which will challenge the powerful resistance at 75.28, the confluence of the 50 and 100-HMAs.

The bearish bias will remain intact as long as the spot holds below the horizontal 21-HMA at 75.34.

AUD/JPY: Hourly chart

AUD/JPY additional levels

AUD/JPY additional levels

AUD/JPY additional levels

AUD/JPY additional levels