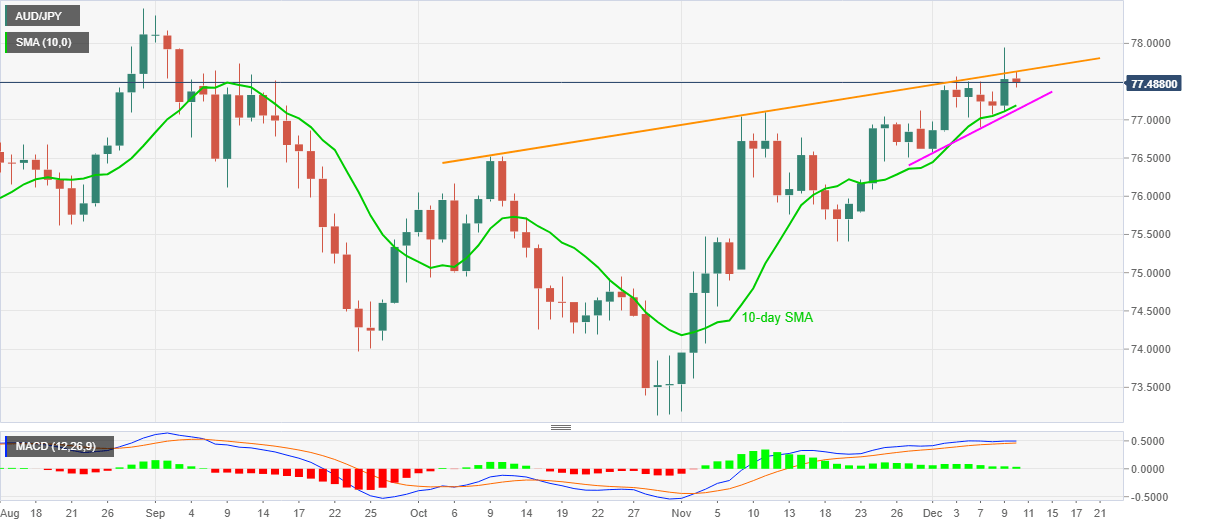

- AUD/JPY drops after refreshing three-month top the previous day.

- Dwindling MACD, repeated failures to cross the key resistance line suggest further weakness.

- 10-day SMA, monthly support line on the bear’s radar.

AUD/JPY stays depressed around 77.50 during the pre-Tokyo open on Thursday. The pair recently dropped from 77.63 while extending Wednesday’s pullback from the highest since September 03. In doing so, the quote takes another U-turn from an upward sloping resistance line from October 09.

Considering the pair’s fourth failure to cross the key upside hurdle, coupled with the receding strength of bullish MACD, the sellers are looking for entries.

As a result, a confluence of 10-day SMA and a 10-day-old rising support line, around 77.20/10, becomes important to watch.

Should the quote drops below 77.10, also breaks the 77.00 round-figure, AUD/JPY bears might not refrain from targeting the late-November low near 75.40.

Meanwhile, a daily closing beyond the stated resistance line, at 77.65 now, will eye for the yearly top, marked on August 31, near 78.50.

AUD/JPY daily chart

Trend: Further weakness expected