- AUD/JPY extends the drop below 75.00 amid risk-off.

- Bearish technical set up on 4H points to further losses.

- Overbought RSI on Monday called for the downside.

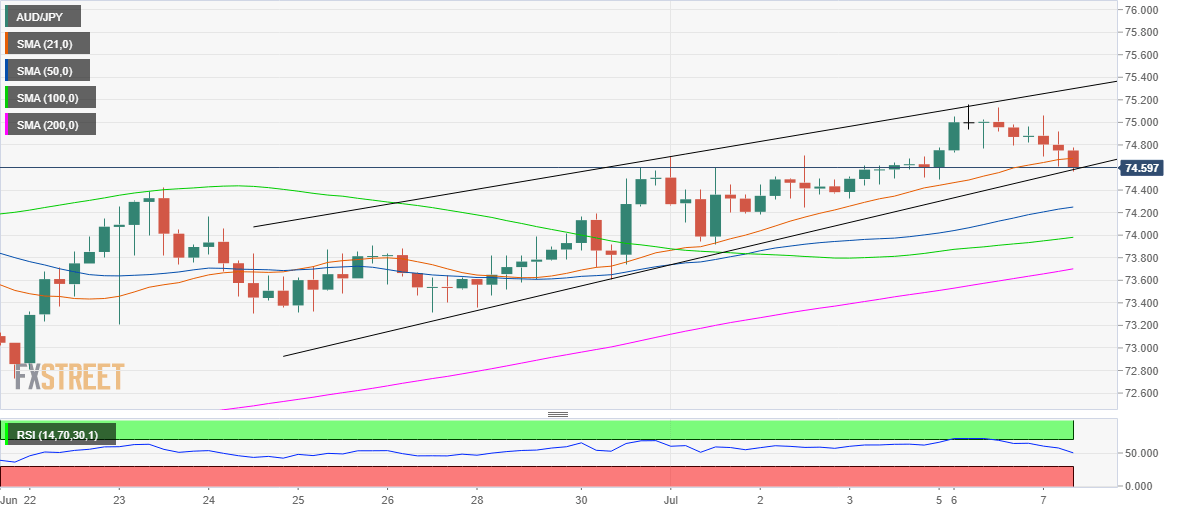

With the catalyst being the coronavirus fears-led risk-off market mood, AUD/JPY is threatening a breach of the rising trendline support at 74.58, which will eventually validate the rising wedge pattern on the four-hour chart (4H).

The weakness in the cross was already projected by the overbought Relative Strength Index (RSI) on Monday, as noted here. Meanwhile, the RSI has reversed sharply and now looks to pierce through the midline (50.0), in order to enter the bearish territory. This suggests that the further downside appears more compelling.

Bolstering the bearish bias, the price has breached the 21-4H SMA, currently at 74.68, for the first time since end-June. If the pattern gets confirmed, a test of the target at 71.20 cannot be ruled out in the week ahead.

Although, the 74.20-74.00 demand are could help slow down the declines. That zone is the confluence of the 50 and 100-4H SMAs. Further south, the upward sloping 200-4H SMA support at 73.70 could be also tested.

If the price manages to sustain above the aforesaid critical support at 74.58, a minor rebound could be possible. However, closing above the 21-4H SMA is needed to revive the bullish momentum in the near-term.