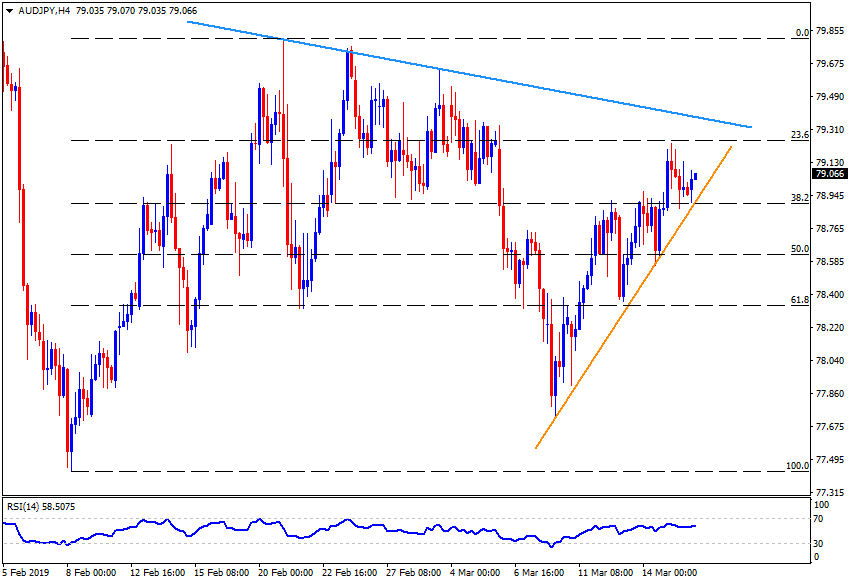

- AUD/JPY took a U-turn from two-week-old ascending trendline as it trades near 79.10 during early Monday.

- 23.6% Fibonacci retracement of February 08 to 21 upside, at 79.30 acts as immediate resistance for the pair, a break of which can propel it to a descending resistance-line stretched since February 21 around 79.45.

- Assuming buyers’ ability to conquer 79.45, 79.60, 79.85 and 80.00 could flash in their radar.

- Meanwhile, a downside break of 78.90 support-line figure might drag the quote to 78.50, 78.30 and 78.00 consecutive supports.

- Additional downside under 78.00 can avail 77.70 and 77.40 as rest points.

AUD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 79.05

Today Daily change: 8 pips

Today Daily change %: 0.10%

Today Daily Open: 78.97

Trends:

Daily SMA20: 78.97

Daily SMA50: 78.62

Daily SMA100: 79.7

Daily SMA200: 80.53

Levels:

Previous Daily High: 79.25

Previous Daily Low: 78.85

Previous Weekly High: 79.25

Previous Weekly Low: 77.91

Previous Monthly High: 79.85

Previous Monthly Low: 77.44

Daily Fibonacci 38.2%: 79.1

Daily Fibonacci 61.8%: 79

Daily Pivot Point S1: 78.8

Daily Pivot Point S2: 78.62

Daily Pivot Point S3: 78.4

Daily Pivot Point R1: 79.2

Daily Pivot Point R2: 79.42

Daily Pivot Point R3: 79.6