- AUD/JPY is taking the bids around 79.00 on early Thursday.

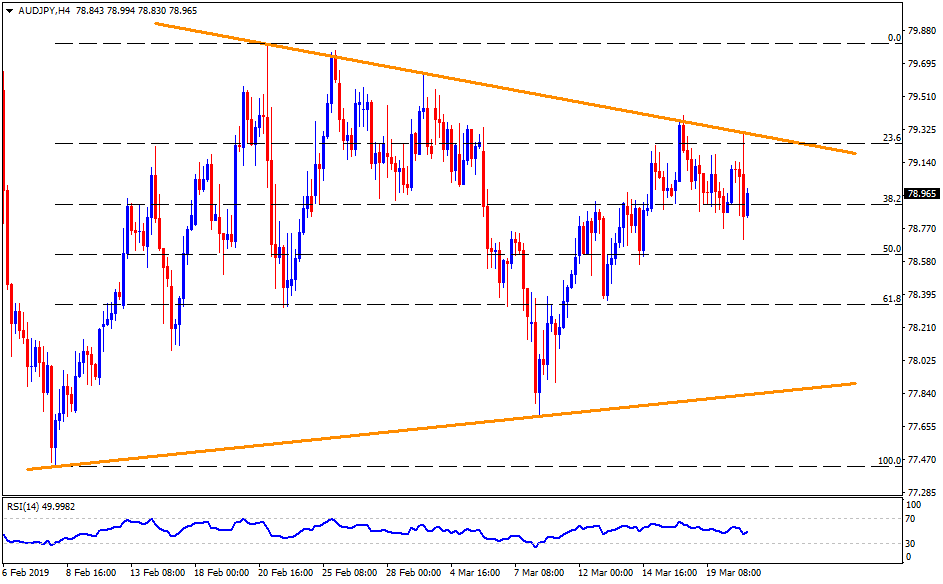

- Pair continues to find difficulties in crossing four-week-old descending trend-line, at 79.35 now, ahead of monthly Australian employment data.

- As a result, 50% Fibonacci retracement of February month rise, at 78.65, becomes important for sellers in case job numbers spread disappointment.

- Should prices refrain from respecting 78.65 support, 61.8% Fibonacci retracement level near 78.30, followed by 78.10, could lure bears.

- Assuming the quote’s extended south-run beneath 78.10, 77.70 and 77.40 could come back on the chart.

- Meanwhile, an upside break of 79.35 can quickly trigger price up-moves to 79.60 ahead of highlighting February month high near 79.85 and then drawing market attention to 80.00.

- It should also be noted that a price rally beyond 80.00 gives importance to the 200-day simple moving average (SMA) figure of 80.45 as resistance.

AUD/JPY 4-Hour chart