- Sustained break of 21-DMA, gradually increasing RSI favors the pair’s upside.

- 76.40/28 becomes the key upside barrier to watch on the break of 50-DMA.

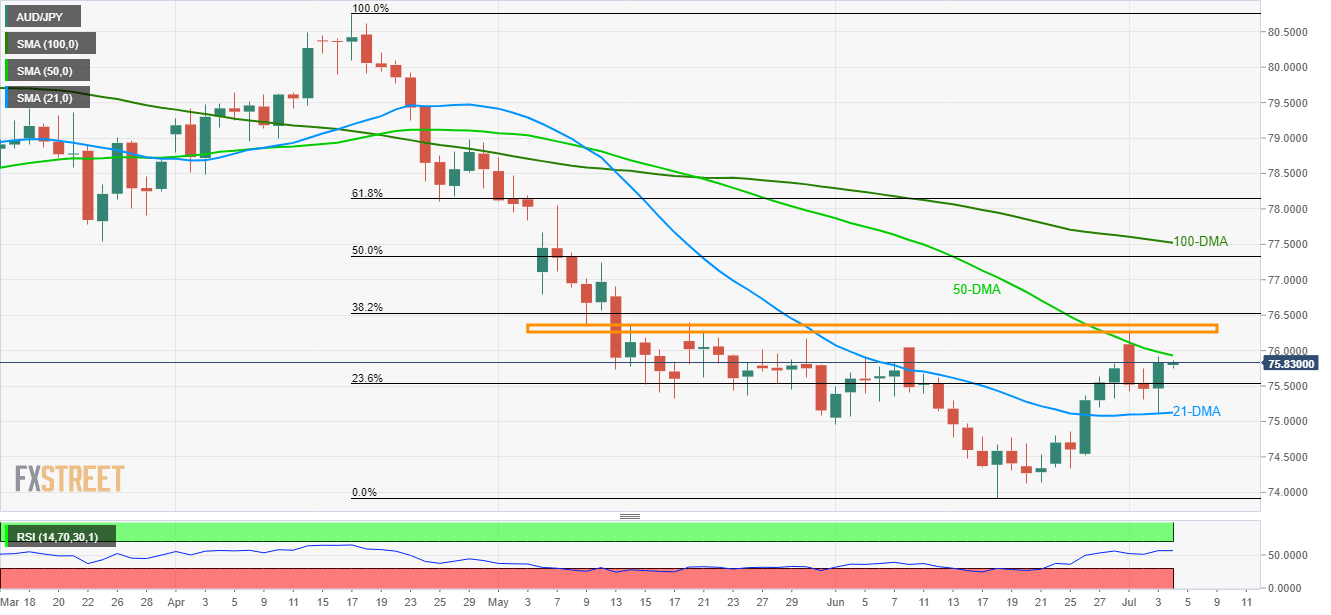

Despite trading successfully beyond 21-day moving average (21-DMA), AUD/JPY still falls short of clearing 50-DMA resistance as it takes the bids to 75.83 amid initial Asian trading on Thursday.

A break of 75.93 comprising 50-day moving average (50-DMA) enables buyers to again confront the 2-month resistance area, namely 76.40/28, that holds the gate for the quote’s further north-run in the direction to 50% Fibonacci retracement of April-June downpour, at 77.34, followed by 100-DMA level of 77.52.

On the contrary, 23.6% Fibonacci retracement at 75.53 and 21-DMA mark around 75.13 can keep entertaining short-term sellers.

Given the prices decline below 75.13, multiple highs marked during late-June near 74.80 and the June month bottom at 73.92 seems to please bears.

It should also be noted that gradual rise of the 14-day relative strength index (RSI), far from the overbought region, favors the pair’s immediate upside.

AUD/JPY daily chart

Trend: Bullish