- AUD/JPY struggles to extend recent advances, at six week high.

- 61.8% Fibonacci retracement and a rising trend-line since August 06 question buyers.

- Bearish MACD offers an additional challenge to the upside.

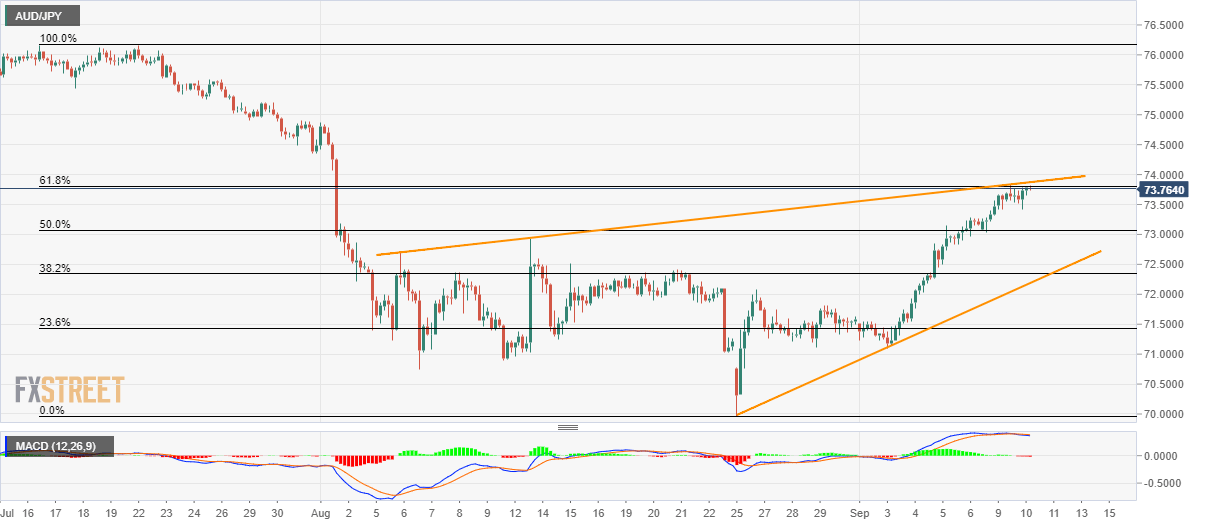

Despite rising to a six-week high, AUD/JPY up-moves have recently been challenged as the quote trades near 73.80 amid initial Asian session on Wednesday.

Not only 61.8% Fibonacci retracement level of mid-July to late-August downpour, at 73.81, but a rising trend-line since August 06, at 73.88 now, also question the bulls. Also adding restrictions to the upside is the bearish signal by 12-bar moving average convergence and divergence (MACD) indicator.

With this, the quote is more likely to witness a pullback towards 50% Fibonacci retracement level of 73.07 whereas August 13 high of 72.93, 38.2% Fibonacci retracement at 72.34 and an upward sloping trend-line since August 25 near 72.20 could please sellers. However, pair’s declines below 72.20 will confirm a short-term rising-wedge bearish formation and could extend the south-run towards sub-70.00 area.

Meanwhile, an upside clearance of 73.90, also breaking 74.00 round-figure, could escalate the pair’s rally towards 75.00 and mid-July top nearing 76.15.

AUD/JPY 4-hour chart

Trend: pullback expected