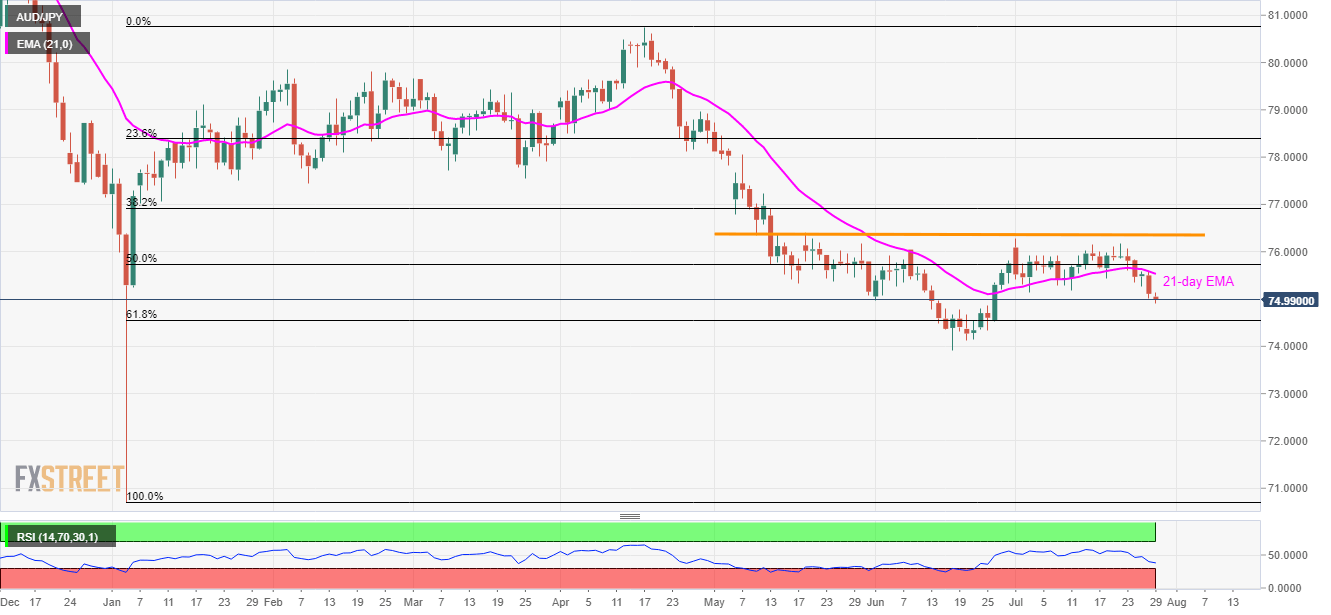

- Sustained beak below 21-day EMA portrays AUD/JPY weakness.

- Buyers may look for entering above 76.40.

While sustained trading below the 21-day exponential moving average (EMA) portrays the AUD/JPY pair’s weakness, the quote seesaws near 74.9810 ahead of the EU markets’ open on Monday.

The 74.80/78 area comprising mid-June highs can offer an intermediate halt ahead of dragging prices to 61.8% Fibonacci retracement of the pair recovery from January month’s flash crash to April top, at 74.5470.

In a case where bears keep dominating below 61.8% Fibonacci retracement level, despite oversold conditions of 14-day relative strength index (RSI), June 20 low of 74.13 and the previous month bottom around 73.92 can lure the sellers.

Alternatively, 21-day EMA level of 75.53 acts as an immediate resistance ahead of 50% Fibonacci retracement level of 75.7376. Though, buyers will wait for a successful break beyond May 20 top, surrounding 76.40, before targeting 77.00 round-figure.

AUD/JPY daily chart

Trend: Bearish