- AUD/JPY registers three-day losing streak.

- A confluence of 200-bar SMA, 50% Fibonacci retracement limits short-term upside.

- Bearish MACD, a failure to register major recovery keep sellers hopeful.

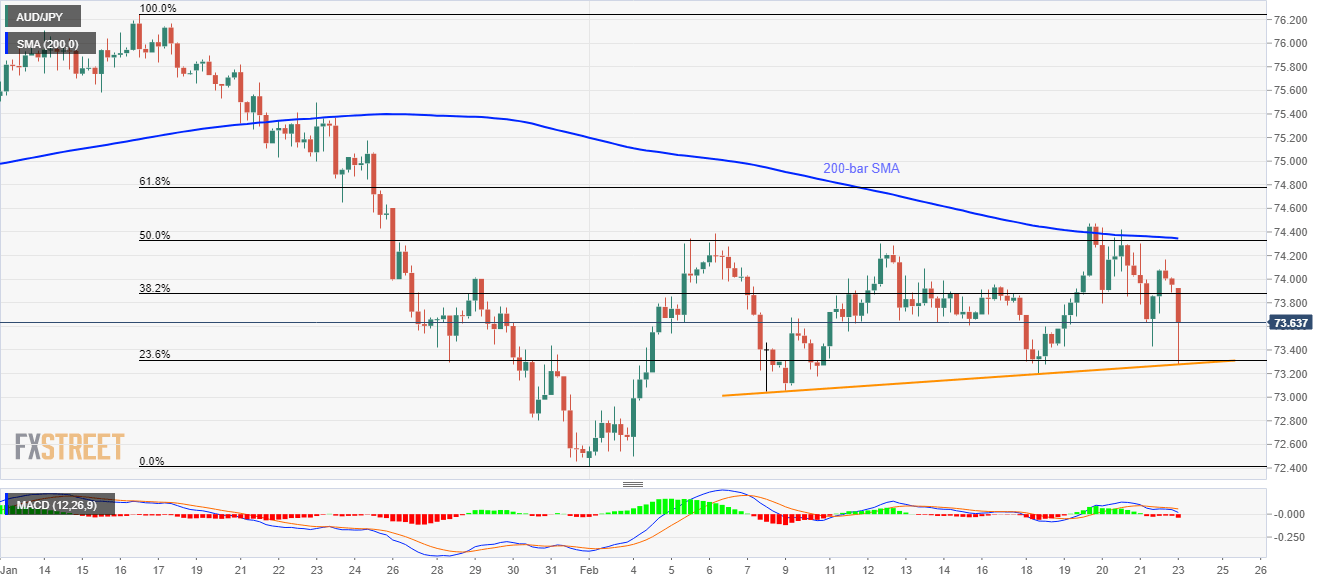

AUD/JPY pulls back from the intra-day low of 73.28 to 73.66 amid Monday’s Asian session. In doing so, the quote portrays a bounce from the two-week-old rising trend line as well as 23.6% Fibonacci retracement of its January-February declines.

However, the strength of the recent U-turn seems to be weak as the MACD still indicates bearish signals, which in turn pushes the sellers to look for entry below 73.28 levels.

That said, 73.00 and 72.80 could be the next on the bears’ radars ahead of the monthly bottom near 72.40.

On the upside, a confluence of 200-bar SMA and 50% Fibonacci retracement near 74.35 acts as the key resistance, a break of which can push the quote towards 61.8% Fibonacci retracement level of 74.80.

AUD/JPY four-hour chart

Trend: Bearish