- AUD/JPY trades near 79.35 after the release of China’s Caixin Manufacturing PMI on early Friday.

- The February month private gauge of manufacturing purchasing managers’ index (PMI) came in at 49.9 versus 48.5 market forecast in February. The PMI registered 48.3 level in January.

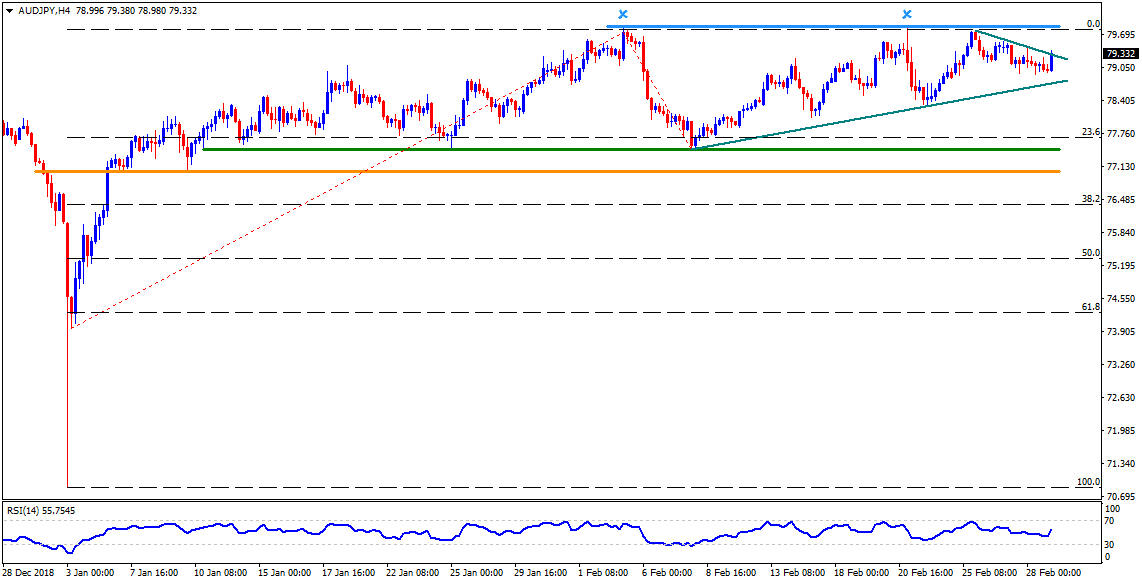

- Should the pair sustains the 79.35 break, it can aim for 79.60 while 79.80-85 region including highs marked during the month can challenge buyers then after.

- During the pair’s rise above 79.85, 61.8% Fibonacci expansion (FE) of its early January – February moves at 81.00 could become Bulls’ favorite.

- On the flipside, a support-line joining lows of February 08 and 21 may limit the pair’s immediate declines at 78.70, a break of which can drag it to 78.25 and 78.00.

- If at all bears keep ruling the sentiment after 78.00. horizontal supports around 77.40 and 77.00 could gain market attention.

AUD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 79.19

Today Daily change: 12 pips

Today Daily change %: 0.15%

Today Daily Open: 79.07

Trends:

Daily SMA20: 78.87

Daily SMA50: 78.31

Daily SMA100: 79.81

Daily SMA200: 80.76

Levels:

Previous Daily High: 79.47

Previous Daily Low: 78.93

Previous Weekly High: 79.82

Previous Weekly Low: 78.33

Previous Monthly High: 79.85

Previous Monthly Low: 77.44

Daily Fibonacci 38.2%: 79.14

Daily Fibonacci 61.8%: 79.27

Daily Pivot Point S1: 78.84

Daily Pivot Point S2: 78.62

Daily Pivot Point S3: 78.3

Daily Pivot Point R1: 79.38

Daily Pivot Point R2: 79.7

Daily Pivot Point R3: 79.92