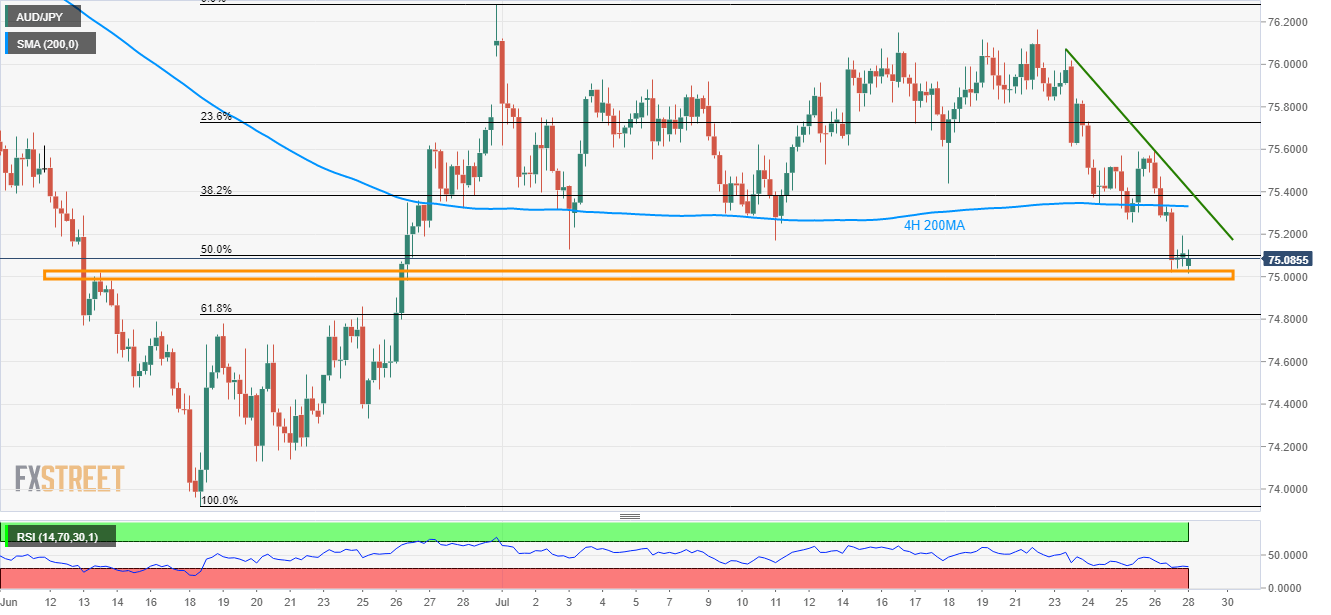

- AUD/JPY buyers can enter around mid-June top, 75.00 round-figure considering oversold RSI conditions.

- 4H 200MA, short-term falling trend-line seem nearby key resistances.

Having dropped to the lowest levels in a month, the AUD/JPY pair recovers to 75.10 during the early Asian session on Monday.

Oversold conditions of 14-bar relative strength index (RSI) played their role in triggering the quote’s bounce from 75.00 – 74.98 region, comprising mid-June high and the round-figure.

However, 200-bar moving average on the 4-hour chart (4H 200MA), at 75.33, followed by a 4-day long descending trend-line near 75.41 can still challenge the pair’s pullback, if not then last-week high surrounding 75.60 can come back on the chart.

Meanwhile, pair’s dip beneath 74.98 can fetch it to 61.8% Fibonacci retracement of June month upside, at 74.82, whereas 74.30 and early-June low close to 74.13 can please sellers then after.

AUD/JPY 4-hour chart

Trend: Pullback expected