- AUD/JPY flirts with 79.00 during early Tuesday.

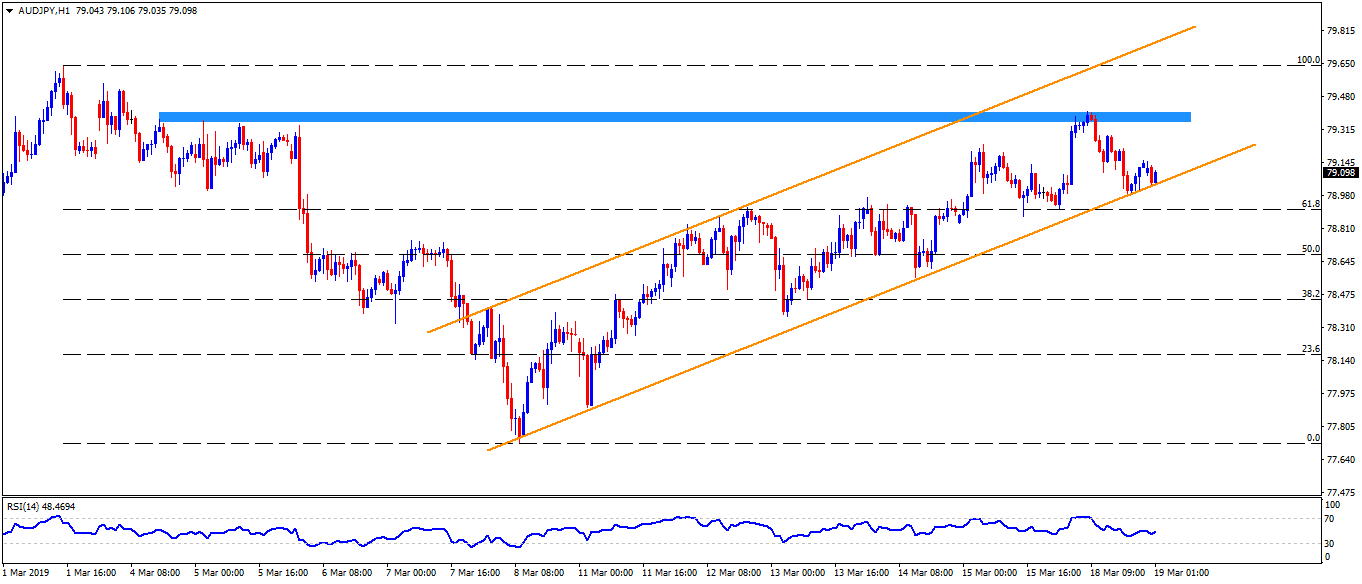

- Having reversed from 79.35-40 horizontal-resistance during Monday, the quote dropped to test support-line of an ascending trend-channel formation established since March 08.

- The formation support near 79.00 round-figure becomes an immediate important support for the sellers to watch as a break of which can drag the quote down to 50% Fibonacci retracement level of 78.70 whereas 78.40/35 and 78.15 likely entertaining bears afterward.

- During pair’s additional weakness under 78.15, 77.90 and 77.70 could regain market attention.

- On the contrary, 79.20 may limit nearby upside prior to shifting the focus back on 79.35/40 area comprising highs marked during recent two weeks.

- Given the pair’s ability to cross 79.40, current month high around 79.65, followed by channel-resistance of 79.80 and 80.00 mark could please buyers.

AUD/JPY hourly chart

Additional important levels:

Overview:

Today Last Price: 79.09

Today Daily change: 12 pips

Today Daily change %: 0.15%

Today Daily Open: 78.97

Trends:

Daily SMA20: 78.97

Daily SMA50: 78.62

Daily SMA100: 79.7

Daily SMA200: 80.53

Levels:

Previous Daily High: 79.25

Previous Daily Low: 78.85

Previous Weekly High: 79.25

Previous Weekly Low: 77.91

Previous Monthly High: 79.85

Previous Monthly Low: 77.44

Daily Fibonacci 38.2%: 79.1

Daily Fibonacci 61.8%: 79

Daily Pivot Point S1: 78.8

Daily Pivot Point S2: 78.62

Daily Pivot Point S3: 78.4

Daily Pivot Point R1: 79.2

Daily Pivot Point R2: 79.42

Daily Pivot Point R3: 79.6