- AUD/JPY follows a bearish technical pattern below the key moving average.

- Oversold RSI conditions around the channel’s support can trigger pair’s pullback.

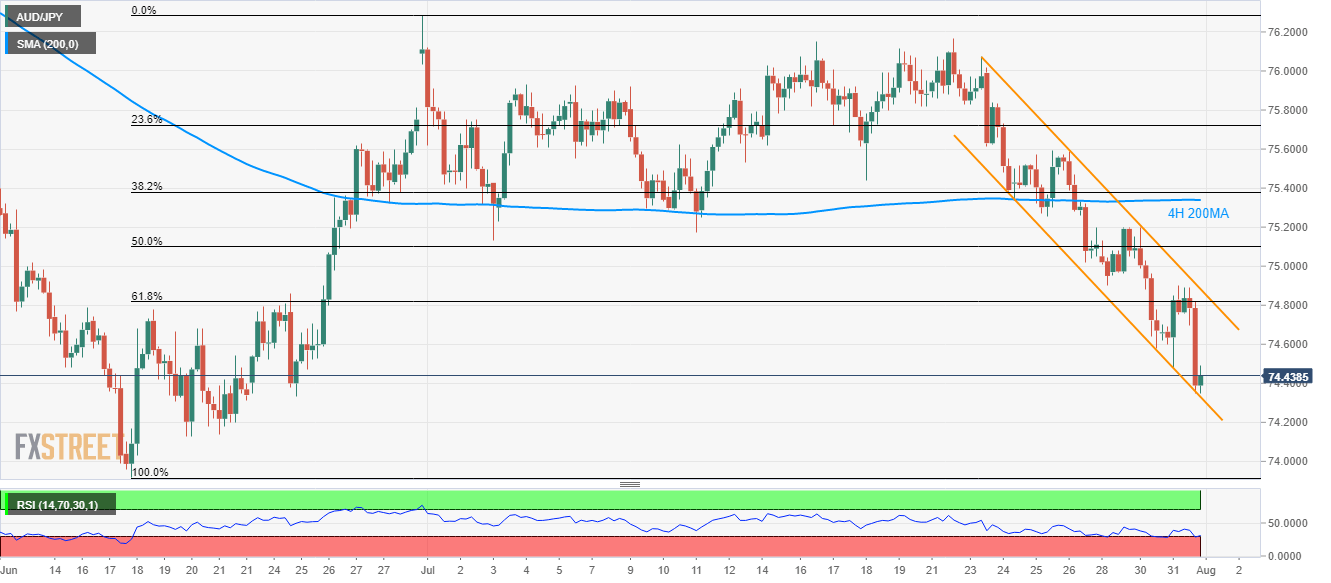

A short-term falling trend-channel below 4H 200MA portrays the AUD/JPY pair’s weakness as it trades near 74.43 during the early Asian session on Thursday.

However, oversold conditions of 14-bar relative strength index (RSI) around the channel support favor the odds of a pullback to 74.70 whereas 61.8% Fibonacci retracement of June month upside and channel-resistance, at 74.82 and 74.88 respectively, can question further advances.

Should buyers manage to cross 74.88, 50% Fibonacci retracement level of 75.10 can offer an intermediate halt during the run-up to 200-bar moving average on the 4-hour chart (4H 200MA) near 75.34.

Meanwhile, pair’s slip beneath 74.33 channel support could highlight 74.10 and June month low close to 73.90 for sellers.

AUD/JPY 4-hour chart

Trend: Bearish