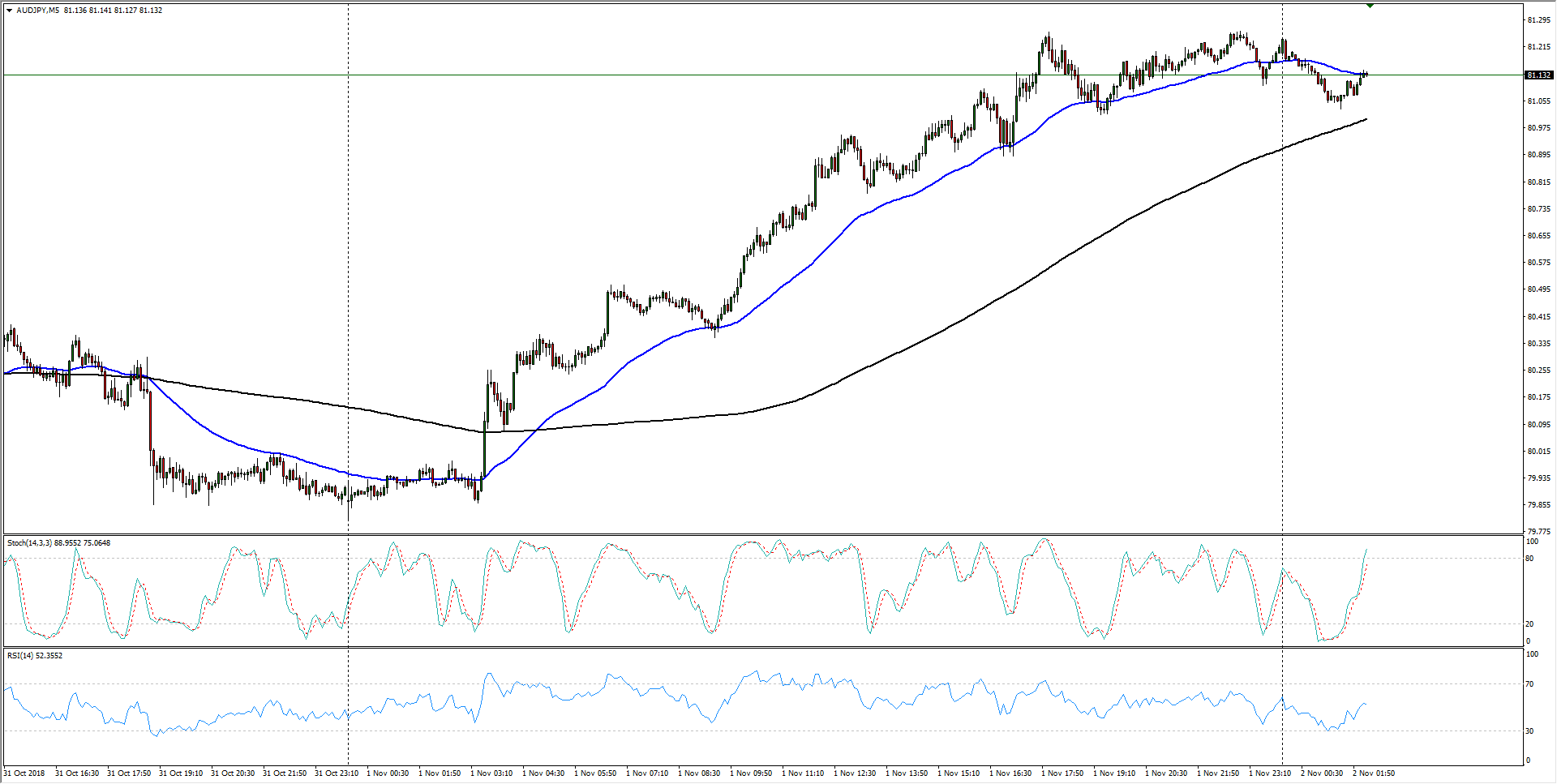

The last twenty-four hours have seen the AUD/JPY grind higher, clipping back over the 81.00 handle before beginning to consolidate heading into the Pacific-Asia trading session testing between the recent peak of 81.26 and the 200-period moving average providing near-term support from 81.00.

AUD/JPY, M5

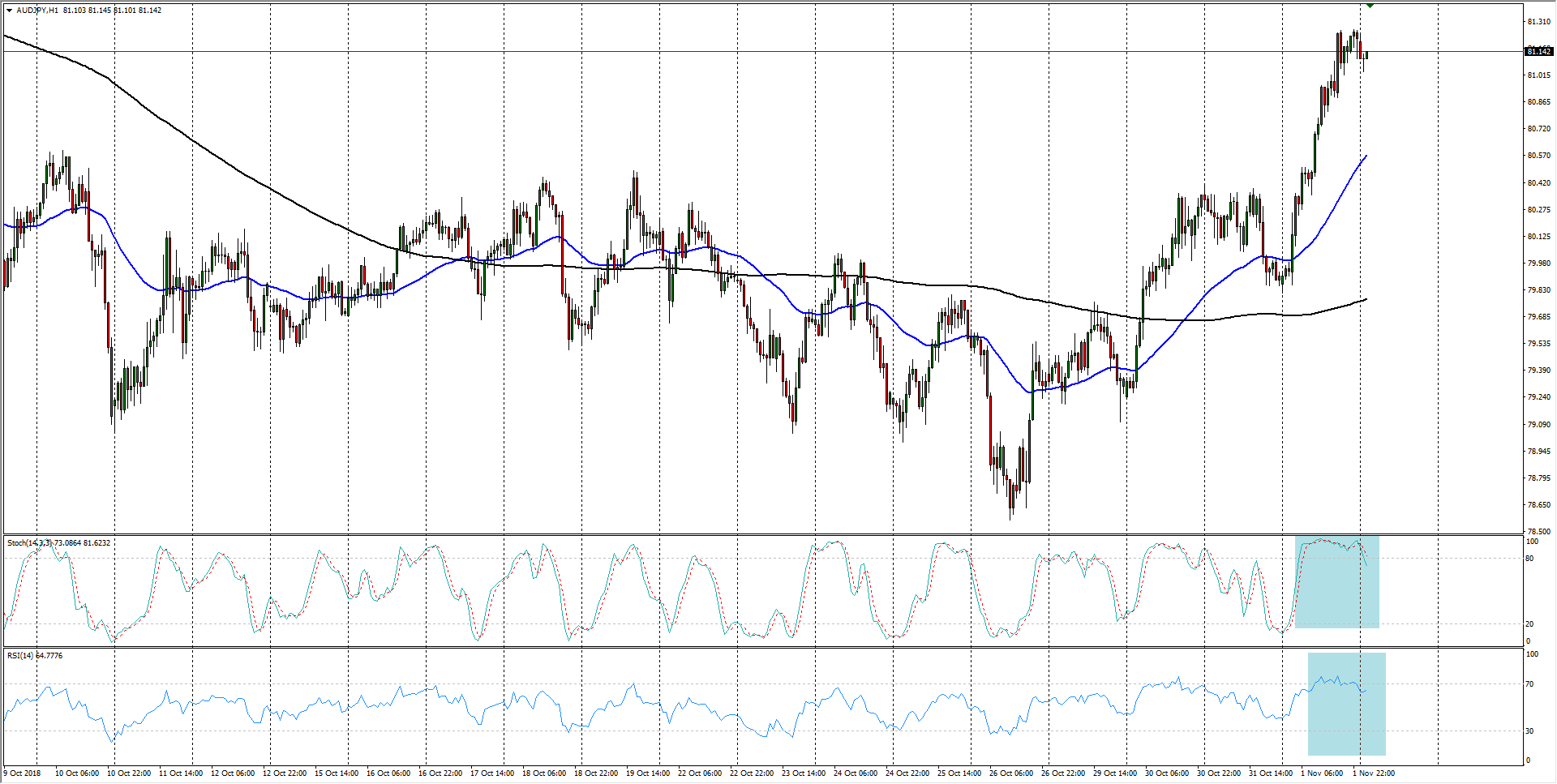

Looking back over the past month, consolidation between 80.40 and 79.00 has largely been the name of the game, and with Thursday’s breakout being aggressively one-sided, Aussie buyers looking to prolong a bullish recovery may be expecting a retracement back to the top-end of recent consolidation before bouncing off of the support-turned-resistance, and overextended hourly indicators are warning of growing potential for an intraday correction.

AUD/JPY, H1

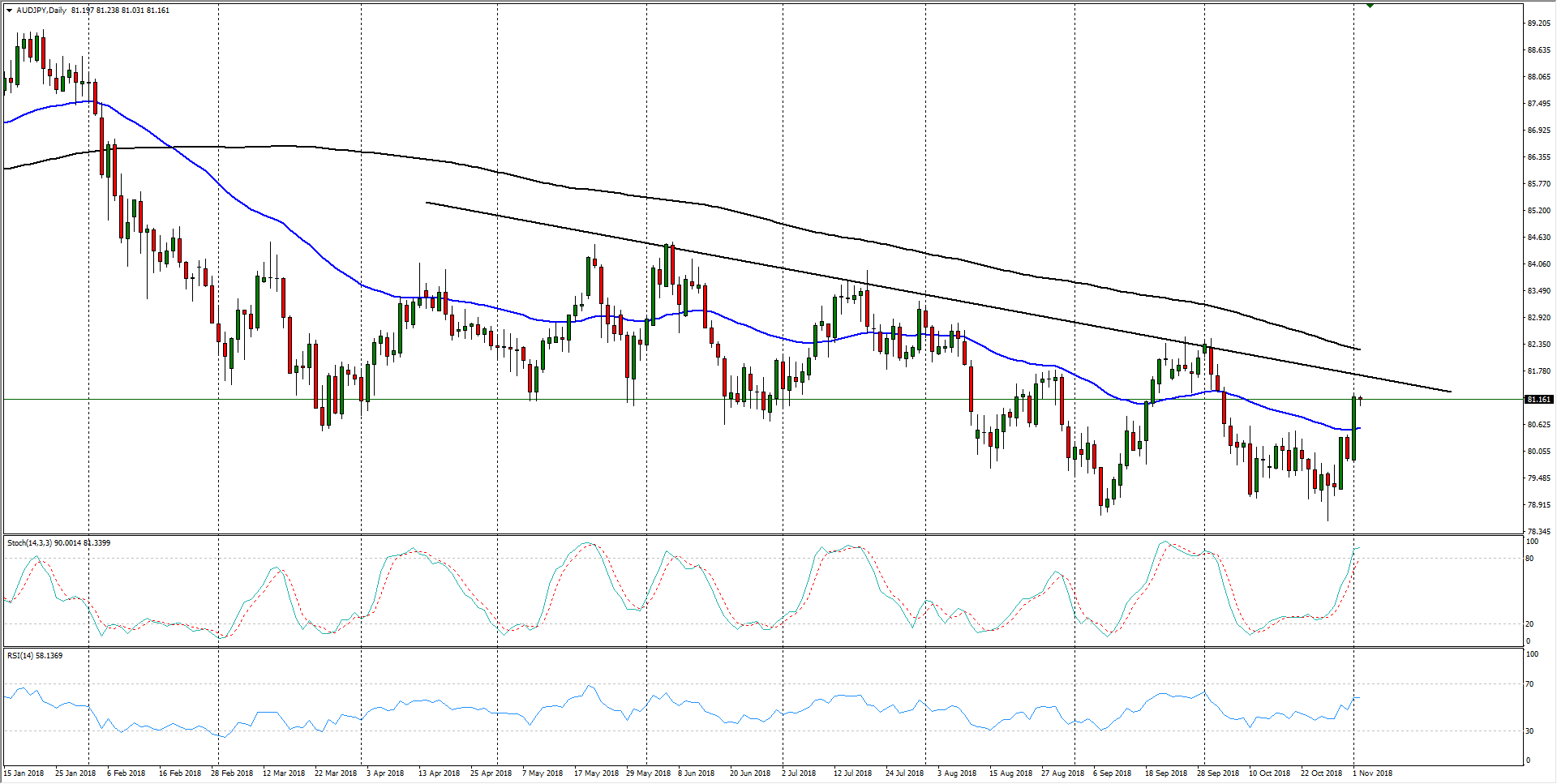

The Daily candlesticks tell a much different story for the AUD/JPY, showing the pair running up into a descending trendline that has remained firmly in place since June of this year, and long AUD positions could run adrift as soon as the 81.50 key level.

AUD/JPY, D1

AUD/JPY

Overview:

Last Price: 81.14

Daily change: 1.3e+2 pips

Daily change: 1.58%

Daily Open: 79.88

Trends:

Daily SMA20: 79.86

Daily SMA50: 80.49

Daily SMA100: 81.23

Daily SMA200: 82.3

Levels:

Daily High: 80.43

Daily Low: 79.86

Weekly High: 80.32

Weekly Low: 78.56

Monthly High: 82.5

Monthly Low: 78.56

Daily Fibonacci 38.2%: 80.07

Daily Fibonacci 61.8%: 80.21

Daily Pivot Point S1: 79.68

Daily Pivot Point S2: 79.48

Daily Pivot Point S3: 79.11

Daily Pivot Point R1: 80.26

Daily Pivot Point R2: 80.63

Daily Pivot Point R3: 80.83