- AUD/JPY has started out the week on the front foot, adding to the last few sessions of gains as risk appetite keeps improving.

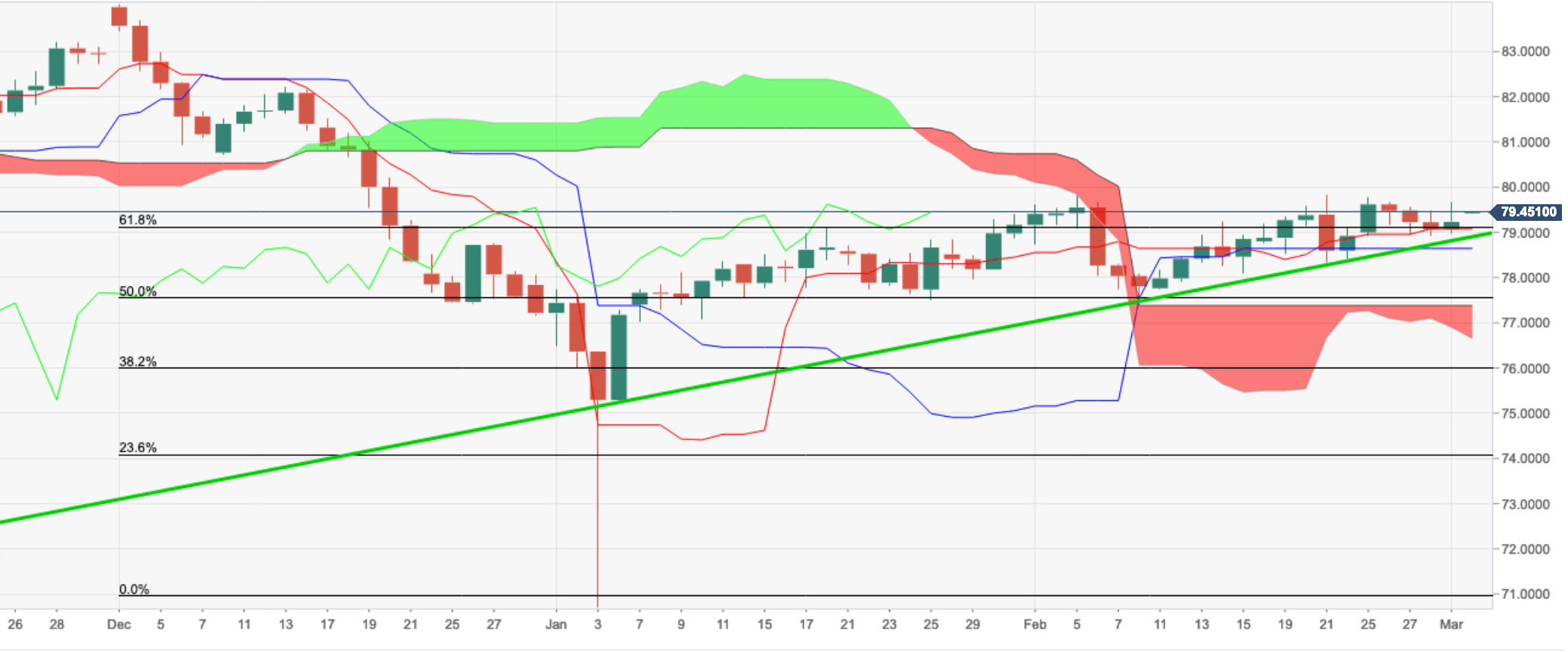

- While price is trending higher, correcting the daily bearish trend, it is a slow grind albeit better bid while above the Ichimoku Cloud.

- However, the conditions for entering long at this stage on the 4hr basis are not sufficient enough with the lagging span too close to price and the Tenkan-sen line below the Kijun-sen.

- The more aggressive bulls might take solace in the daily chart’s conditions, with most of them being met. The price is above the bullish cloud formation, with a bullish alignment in the Tenkan-sen line below the Kijun-sen. However, the lagging span needs to break above the cloud also.

- The price is currently being resisted by the 100-D SMA and a break there will likely give rise to demand creating full conditions for an Ichimoku cloud long entry point above the psychological 80 figure for an initial target of the 78.6% Fibo level and the confluence with 10th Dec support around 80.70/00. On the wide, 83.60/84.50 are compelling as prior support and resistance levels.

- To the downside, trendline support is located a touch below the 79 handle guarding the 61.8% Fibo of the same range around 78.80 as the last defence for the 50% Fibo area around 77.20 which guards the top of the daily cloud at 77 the figure.

AUD/JPY Daily Chart