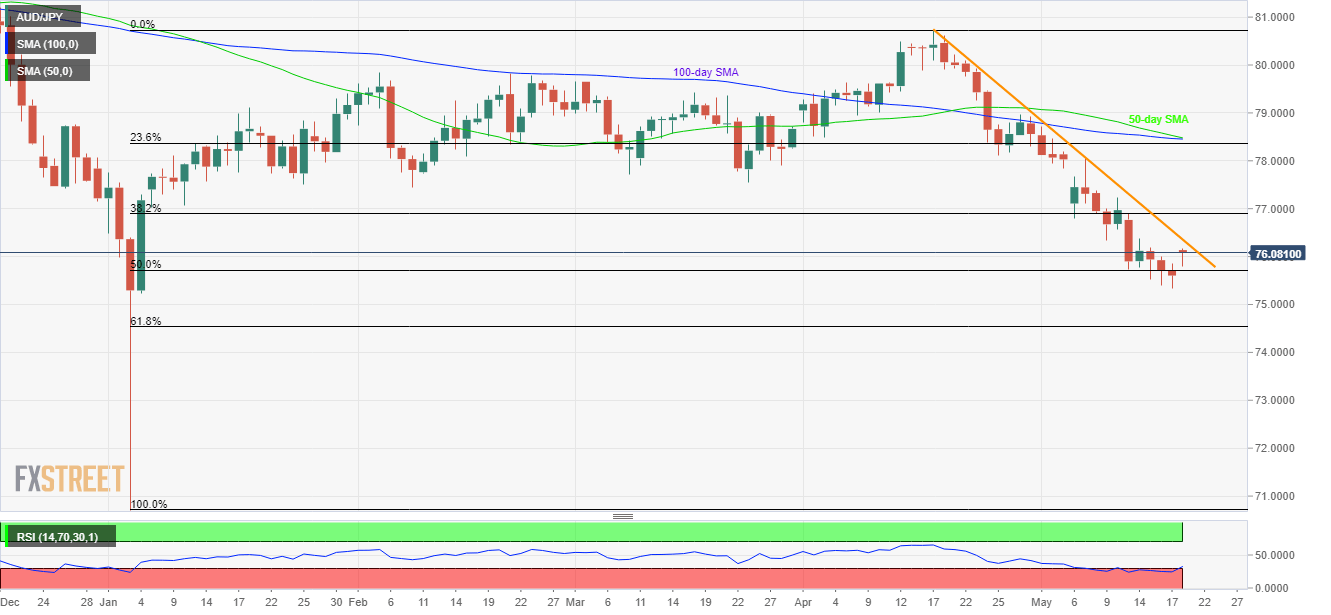

- RSI inching up from oversold region but near-term trend-line could confine the rise.

- Multiple resistances stand tall to question buyers.

AUD/JPY is on the bids near 76.00 during the initial Asian session on Monday. The pair recently surged after Japanese Yen (JPY) reacted more to the previous downward revision than to upbeat present readings of Japan’s Q1 2019 GDP. Adding to the sentiment is the overall strength of the Australian Dollar (AUD) on election results from Australia.

Even if recovery of 14-day relative strength index (RSI) signal further upside by the pair, a downward sloping trend-line since mid-April could question immediate rise around 76.40.

Should prices rally beyond 76.40, the 76.45/55 area comprising multiple lows/highs marked since early January could challenge buyers ahead of highlighting 50-day and 100-day simple moving average (SMA) confluence near 78.45/50.

Alternatively, 50% Fibonacci retracement of January to April upside, at 75.70 acts as nearby support, a break of which can shift bears’ attention to a recent low of 75.33 and then to January 04 bottom surrounding 75.23.

In a case of extended downturn past-75.23, 61.8% Fibonacci retracement level of 74.54 could become sellers’ favorite.

AUD/JPY daily chart

Trend: Pullback expected