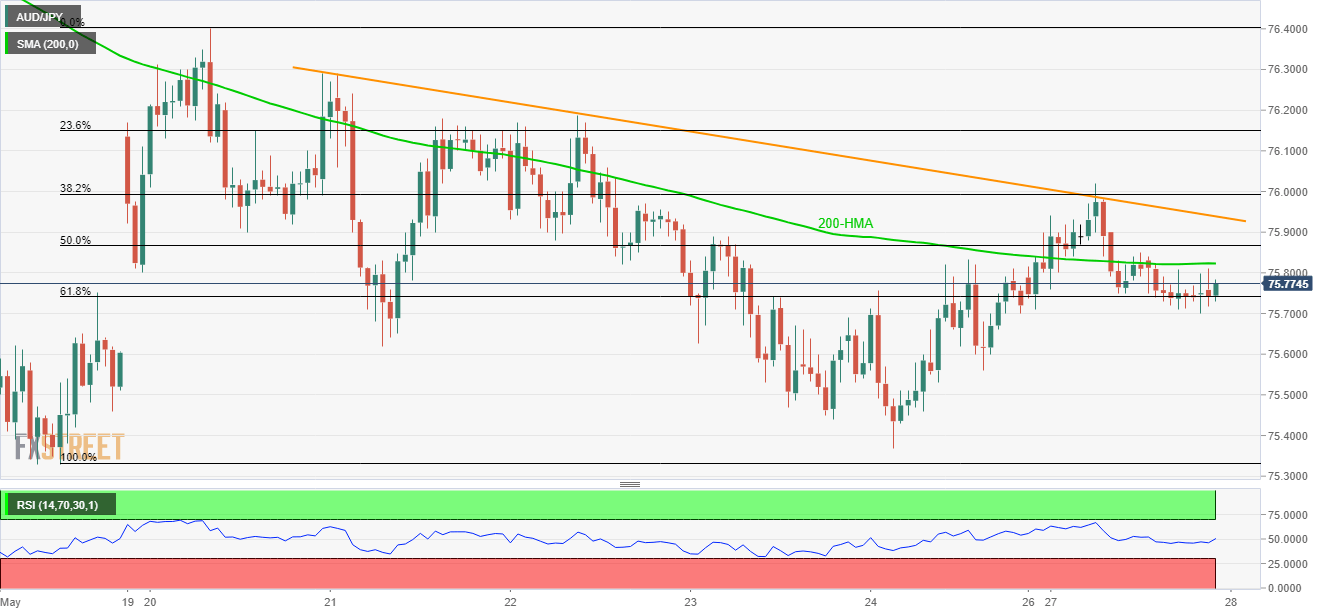

- Momentum confined between 200-HMA and 61.8% Fibonacci retracement.

- Downward sloping trend-line and declines beneath moving average favor bears.

AUD/JPY is modestly unchanged near 75.80 amid initial Asian session on Tuesday. The pair’s downside has lately been confined by 61.8% Fibonacci retracement of its May 17-20 rise while 200-hour simple moving average (200-HMA) seems to limit the near-term upside.

In addition to sustained trading beneath important moving average, a week-long descending trend-line also portrays the pair’s weakness, which in turn can drag the quote to 75.50 and latest lows near 75.30 on the break of 75.75 mark comprising 61.8% Fibonacci retracement.

During further downside under 75.30, 75.00 and 74.50 can flash on sellers’ radar.

Alternatively, a break of 75.85 HMA figure could trigger the pair’s increase towards 75.95 – 76.00 area including the aforementioned trend-line resistance.

Should buyers hold the command past-76.00, 76.20 and 76.40 could be their favorites.

AUD/JPY hourly chart

Trend: Bearish