- Oversold RSI can trigger pullback to early June, 21-DMA.

- Break of the latest low can recall 2016 bottom on the chart.

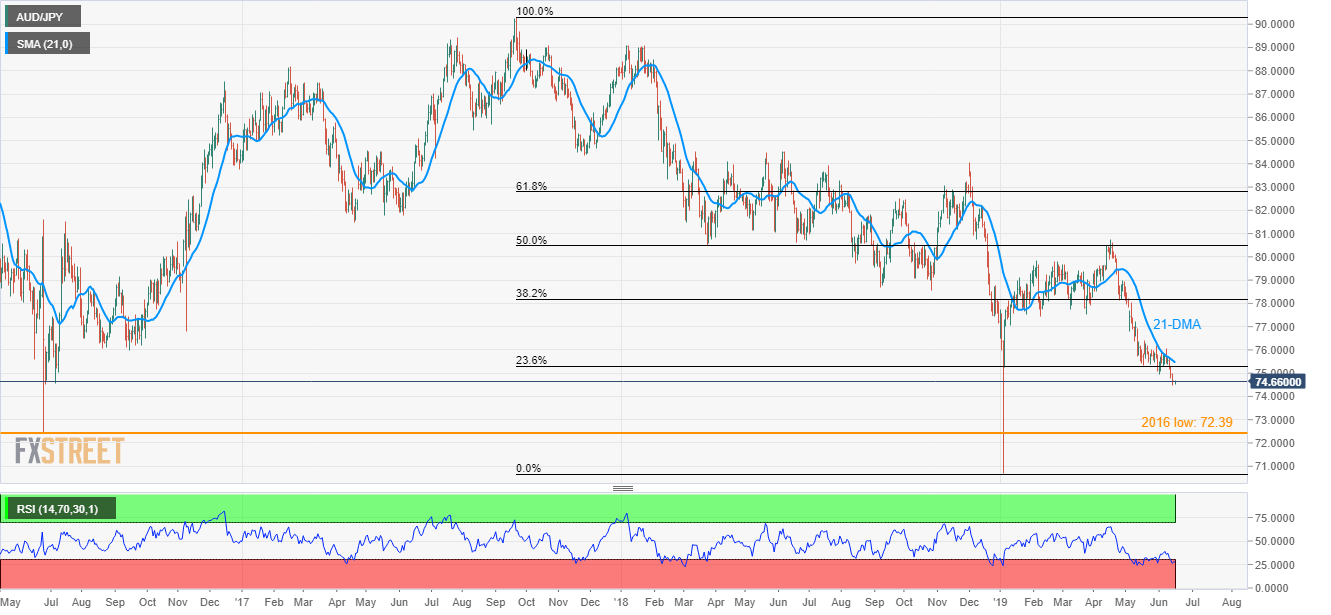

Failure to sustain the break of July 2016 lows, mainly due to oversold RSI, presently questions AUD/JPY sellers as the pair seesaws near 74.66 during the early Asian session on Monday.

Given the oversold levels of 14-day relative strength index (RSI) indicating brighter chances of a pair’s pullback, early-June low surrounding 75.00 and 21-day simple moving average (21-DMA), at 75.45, are much brighter.

Should there be additional upside past-75.45, 76.00 and May 20 top of 76.40 may return to the chart.

Meanwhile, a downside break of latest low surrounding 74.48 opens the gate for the pair extended south-run to the year 2016 trough around 72.40 with 73.00 likely offering an intermediate halt during the slump.

In a case where prices keep declining beneath 72.40, January month bottom near 70.70 should gain bears’ attention.

AUD/JPY daily chart

Trend: Pullback expected