- AUD/JPY sellers struggle to ignore oversold RSI conditions, signaling a pullback to immediate resistances.

- 73.92/84 becomes a key support area in the case of further declines.

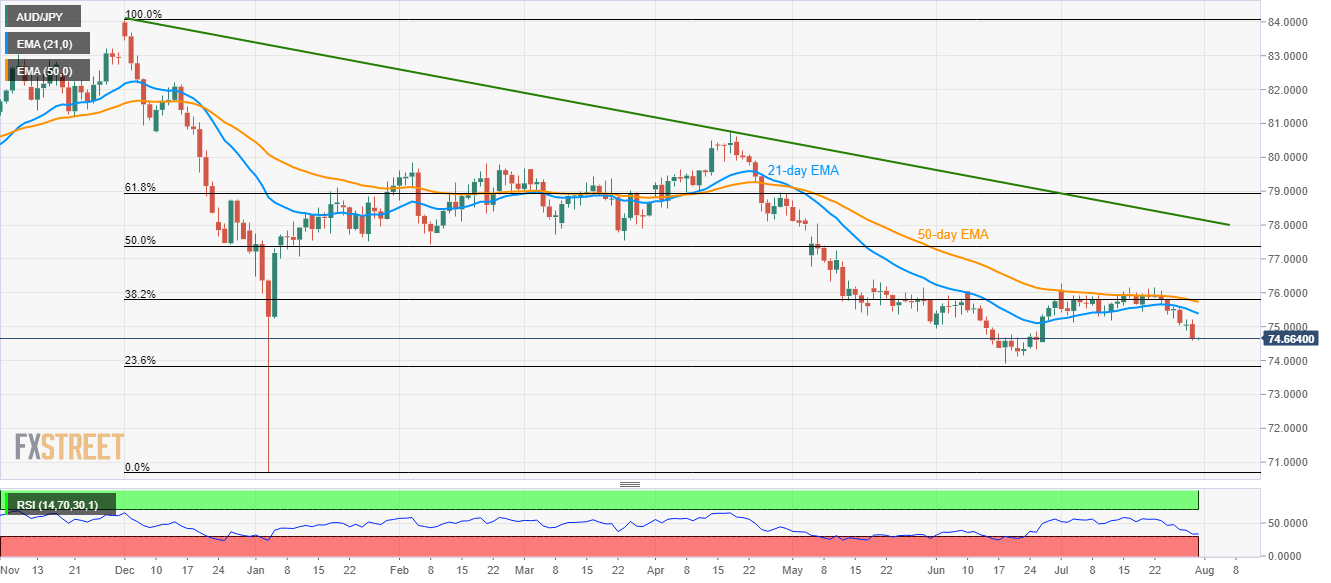

Having slipped beneath 21-day EMA and early-month low, the AUD/JPY pair clings to a five-week low as it trades near 74.6640 during the early Asian session on Wednesday.

While a break of key supports favors the pair’s further declines, oversold conditions of 14-day relative strength index indicate a bounce to challenge July 03 bottom, around 75.13, ahead of confronting the 21-day exponential moving average (EMA) level of 75.38.

It should, however, be noted that the quote’s upside past-75.38 becomes tough due to the presence of 50-day EMA and 38.2% Fibonacci retracement of December 2018 to January 2019 drop occupying 75.73/80 region.

On the contrary, pair’s extended south-run can avail 74.40 and June 20 low near 74.13 as intermediate halts prior to visiting 73.92/84 crucial support area that encompasses June month trough and 23.6% Fibonacci retracement level.

AUD/JPY daily chart

Trend: Pullback expected