- AUD/JPY stays under pressure after downbeat Aussie PMI numbers.

- The monthly low, 61.8% Fibonacci retracement act as immediate supports.

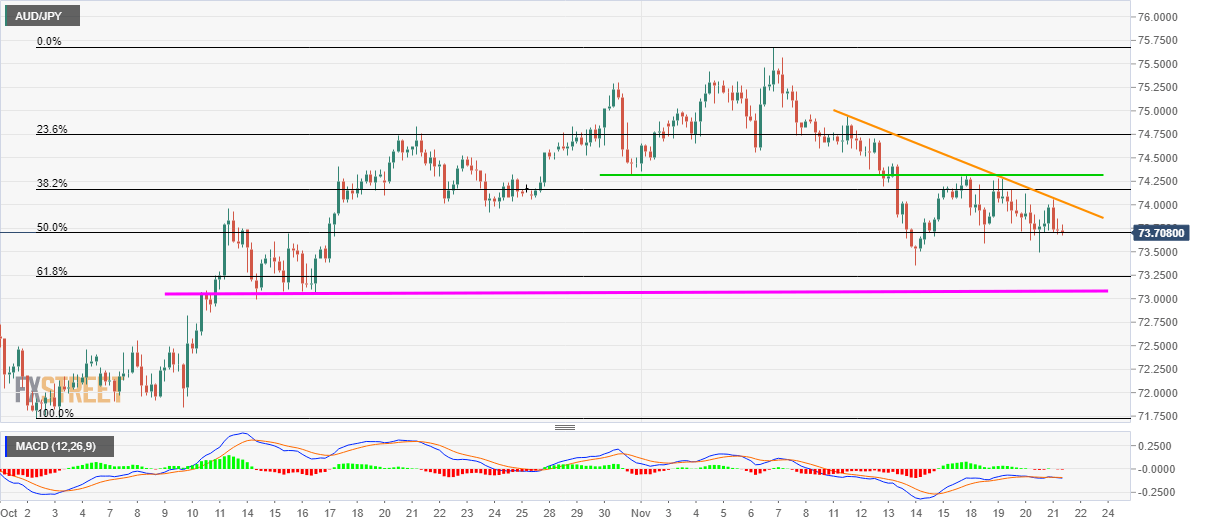

- An eight-day-long falling trend line limits nearby upside.

AUD/JPY keeps it low after the Australian Purchasing Managers Index (PMI) data while taking rounds to 73.73 during early Friday’s Asian session.

Australia’s November month Markit/Commonwealth Bank Manufacturing PMI crossed 49.8 forecasts but slipped beneath 50.1 prior. Further, Services PMI declined to 49.5 versus 53.5 expected and 50.1 earlier. As a result, the Composite PMI dropped to 49.5 from 50.0 prior.

With this, the quote stays below near-term descending trend line while taking rounds to 50% Fibonacci retracement level of October month upside, at 73.70.

While a downtick below 73.30 shifts sellers’ focus to a monthly low of 73.35 and 61.8% Fibonacci retracement level of 73.23, multiple bottoms marked during mid-October, near 73.00, can question bears afterward.

If prices slip below 73.00, 72.50 and the previous month low around 71.70 will be in the spotlight.

Alternatively, an upside clearance of 74.00, comprising the aforementioned resistance line, can propel price to 74.30 horizontal line including October-end low and the recent highs.

It should also be noted that the pair’s successful rise above 74.30 enables buyers to keep a tab on 75.00 while aiming for 75.30/40 and the monthly top close to 75.70 afterward.

AUD/JPY 4-hour chart

Trend: Bearish