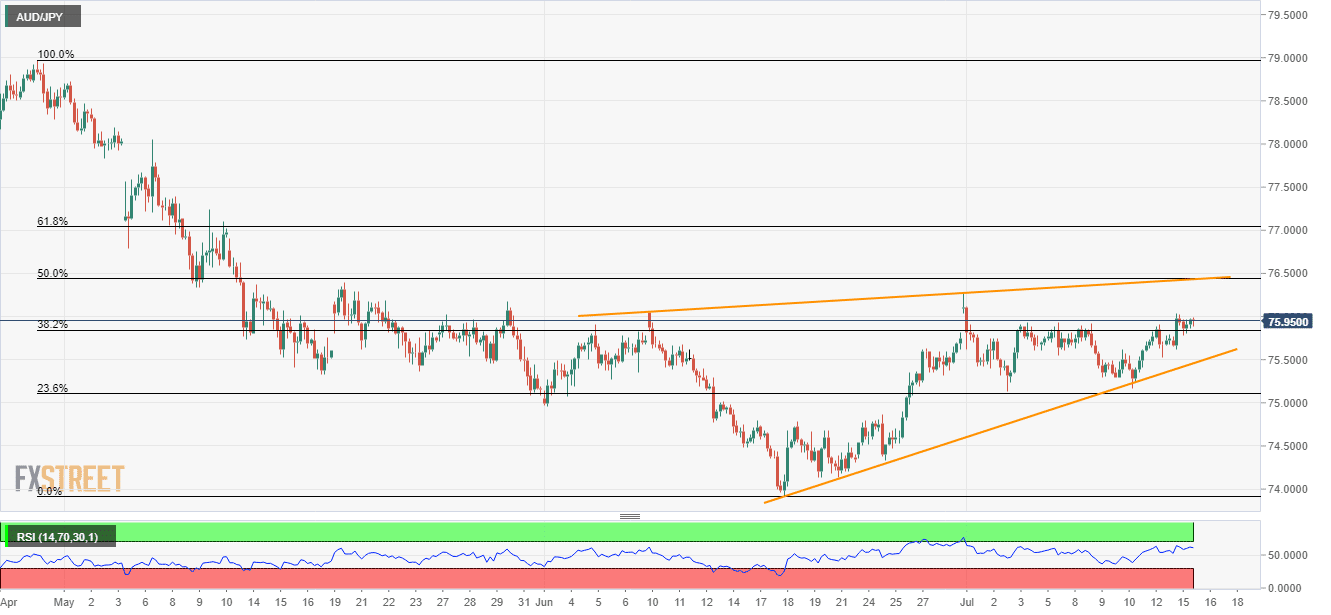

- AUD/JPY holds strong beyond 38.2% Fibonacci retracement.

- Sellers await confirmation of 5-week old bearish formation observing RSI on the run-up to overbought conditions.

Following its gradual rise to a fortnight high, the AUD/JPY pair seesaws around 75.92 during the early Asian session on Tuesday.

While a sustained break of 76.00 becomes necessary for buyers to aim for June month top surrounding 76.30, 50% Fibonacci retracement of April-June downpour and resistance-line of a 5-week old bearish technical pattern, near 76.43/45, could question the bids then after.

In a case prices rally above 76.45, the downturn signaling pattern gets negated and the prices may rise further towards 61.8% Fibonacci retracement level of 77.04.

However, 14-bar relative strength index (RSI) is gradually peaking up, pushing sellers to keep an eye over the 75.45 pattern support with 38.2% Fibonacci retracement level of 75.84 acting as an immediate rest point.

Should the quote slips below 75.45, chances of witnessing 74.80 and June month low close to 73.92 back on the chart can’t be denied.

AUD/JPY 4-hour chart

Trend: Pullback expected