- Failure to cross 50-day simple moving average (SMA) on daily chart, coupled with disappointing China trade balance data, seems dragging the AUD/JPY pair currently towards south on early Friday.

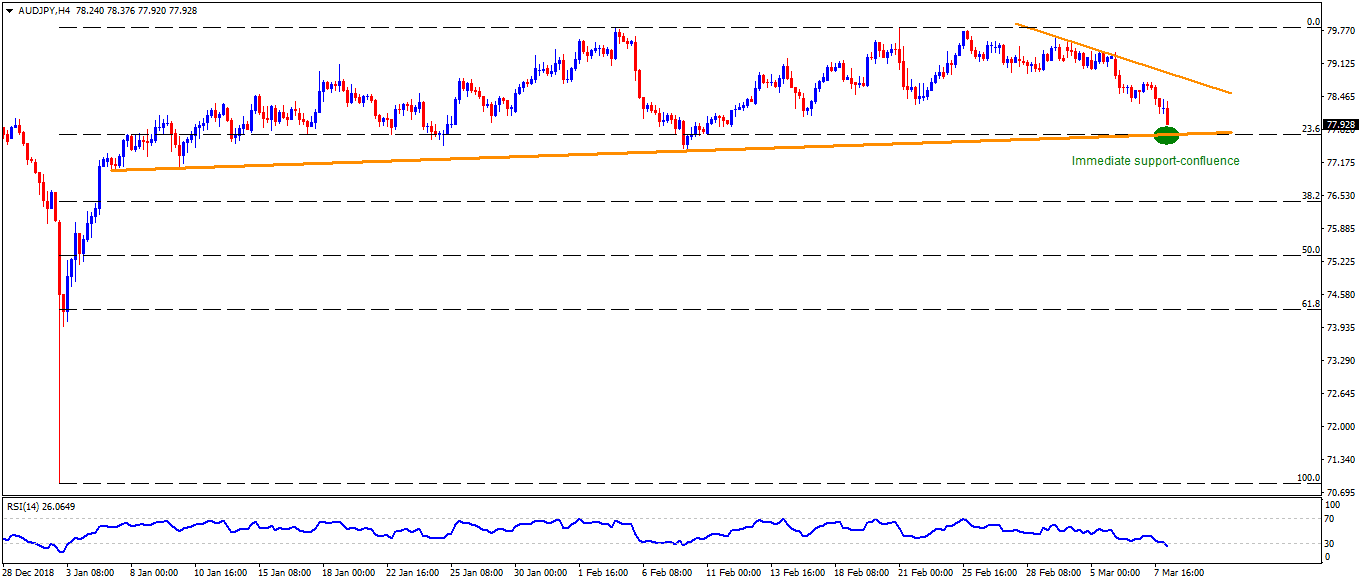

- Sellers look for 77.70 as an important level as it shows a confluence between an upward slopping trend-line connecting lows since January 07 and 23.6% Fibonacci retracement level of its January – February moves.

- Should the pair drops under 77.70, it can quickly test 77.00 and head to 76.00 rest-point then after.

- However, 75.30/25 may limit the pair’s further downside.

- It’s worth pointing out that 14-bar relative strength index (RSI) is in the oversold territory and failure to break 77.70 can trigger the quote’s pullback to the 50-day SMA level of 78.40.

- In case prices rally beyond 78.40, descending trend-line at 78.95, followed by 79.00 and 79.35, can please the Bulls.

AUD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 78.02

Today Daily change: 22 pips

Today Daily change %: -0.28%

Today Daily Open: 78.24

Trends:

Daily SMA20: 78.86

Daily SMA50: 78.39

Daily SMA100: 79.76

Daily SMA200: 80.67

Levels:

Previous Daily High: 78.76

Previous Daily Low: 78.15

Previous Weekly High: 79.79

Previous Weekly Low: 78.91

Previous Monthly High: 79.85

Previous Monthly Low: 77.44

Daily Fibonacci 38.2%: 78.38

Daily Fibonacci 61.8%: 78.53

Daily Pivot Point S1: 78

Daily Pivot Point S2: 77.77

Daily Pivot Point S3: 77.39

Daily Pivot Point R1: 78.62

Daily Pivot Point R2: 78.99

Daily Pivot Point R3: 79.23