- AUD/NZD buyers have to clear near-term key resistances to justify their strength in targeting 1.0500 mark.

- The four-month old horizontal region restricts the pair’s immediate declines.

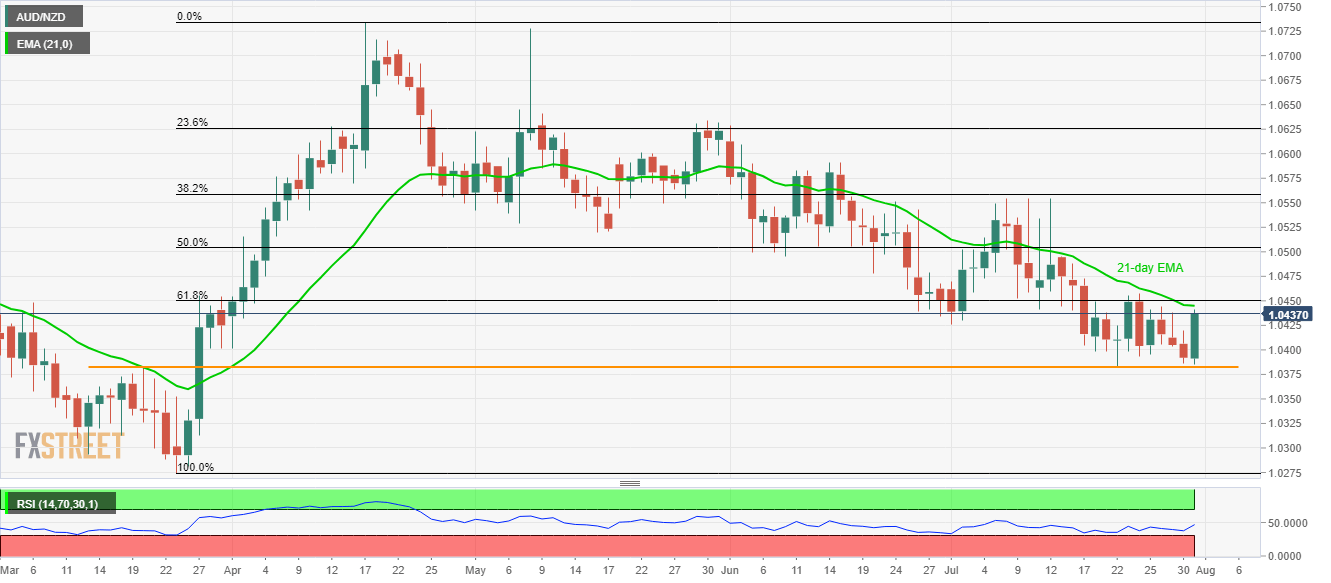

Although a four-month-old horizontal-line confines AUD/NZD declines, the pair is yet to cross key near-term resistances as it takes the bids to 1.0436 amid Asian session on Wednesday.

Upbeat prints of Australia’s second quarter (Q2) Consumer Price Index (CPI) data seems playing their role to lure buyers that were previously challenged by China’s below-50 level Manufacturing Purchasing Managers’ Index (PMI) and doubts over the US-China trade deal.

If prices manage to clear 1.0445 level comprising 21-day exponential moving average (EMA) a successful break of 61.8% Fibonacci retracement of March – April upside, at 1.0450, becomes necessary for buyers to sneak in.

In doing so, early-June low surrounding 1.0500 and 38.2% Fibonacci retracement level of 1.0559 can please the bulls.

On the contrary, 1.0385/80 area comprising current month low to late-March high seem important support for the sellers to watch as a break below the same can recall 1.0300 and March month low around 1.0275 on the chart.

AUD/NZD daily chart

Trend: Pullback expected