- AUD/NZD drifting to the downside from recent resistance, eyes on H&S.

- Cold wars and global trade weighing on the antipodeans.

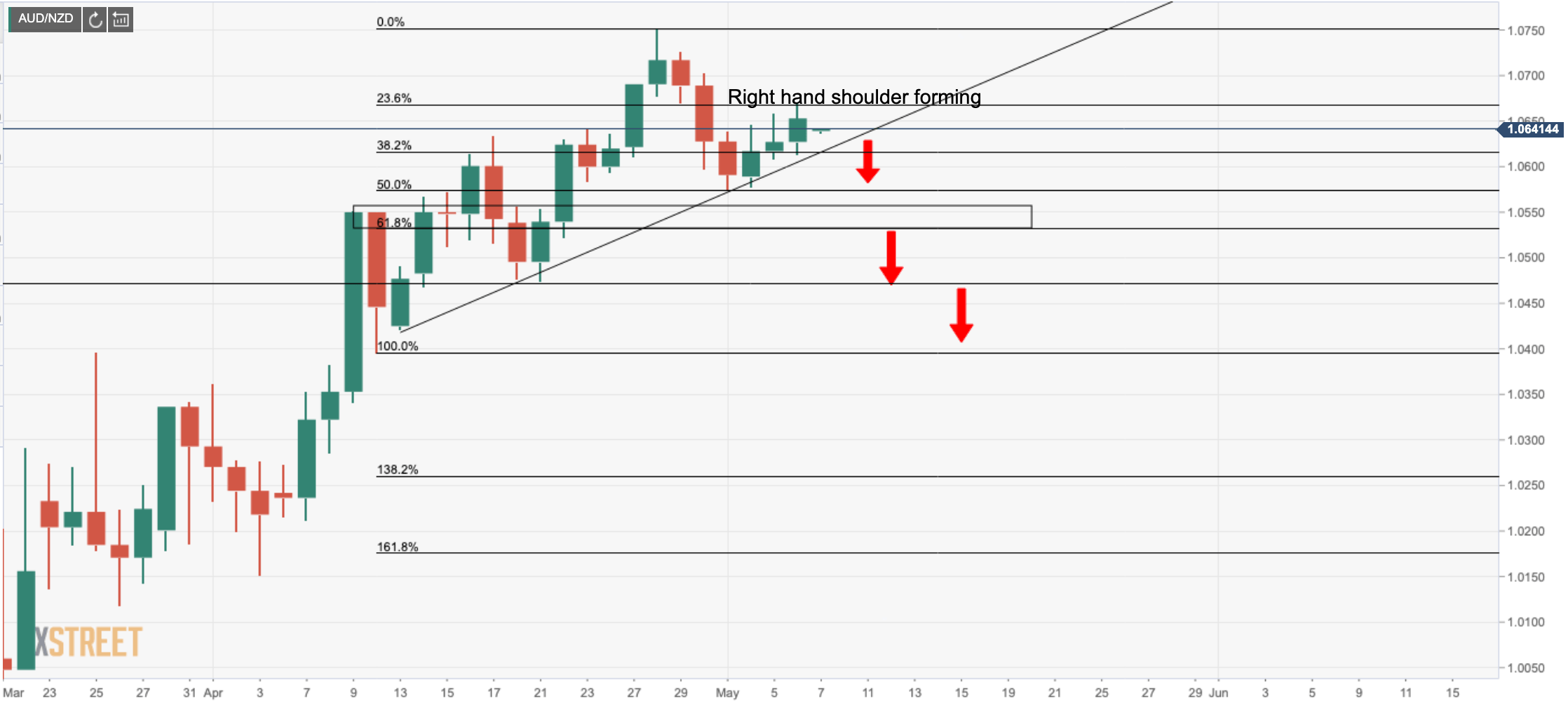

AUD/NZD has given back some ground since topping out at 1.0751 and is being resisted on correction attempts to the upside, with risk mounting up to the downside both technically and fundamentally. At the time of writing, the cross is trading at 1.0636 between a low of 1.0634 and 1.0655.

With the technicals in the process of forming a right-hand H&S shoulder, the Aussie is vulnerable to the escalation of tensions between the US and China. The US administration has stepped up consideration of economic measures against China his week and is holding it accountable for failing to prevent the global spread of the new coronavirus.

A new cold war between Washington and Beijing

Washington is engaging in a so-called new cold war with Beijing with the American hawks criticizing China for downplaying the impact of the COVID-19. Trump’s administration is also reportedly mulling an initiative to remove global industrial supply chains from China and weighing new tariffs to renew a trade war. USD/CNH remains key to the AUD, with the risks slightly tilted to the downside and it has moved higher this week, putting pressure on the Aussie with talk of China abandoning this year’s growth target.

Meanwhile, Kiwi has followed the beleaguered EUR lower, as the US dollar perks up, testing he 100 handle yet again in the DXY. The bird has its own bearish agenda though, so here is little to separate these currencies, AUD and NZD although trade wars should hurt the Aussie more than the kiwi.

A thorn in the side for the NZ dollar is the nation’s key export – milk. Whole milk powder, was effectively unchanged (up 0.1%), which is better than what the futures market had predicted – a 2% fall. However, “it remains 15% below the year’s peak in January, and at US$2745, it is 10% below the average of the past three years ($3040),” analysts at Westpac noted.

H&S formation

AUD/NZD levels