- AUD/NZD fails to extend the previous day’s gains following mixed employment data from New Zealand.

- Early-January lows hold the keys to the pair’s drop towards August 2019 bottom.

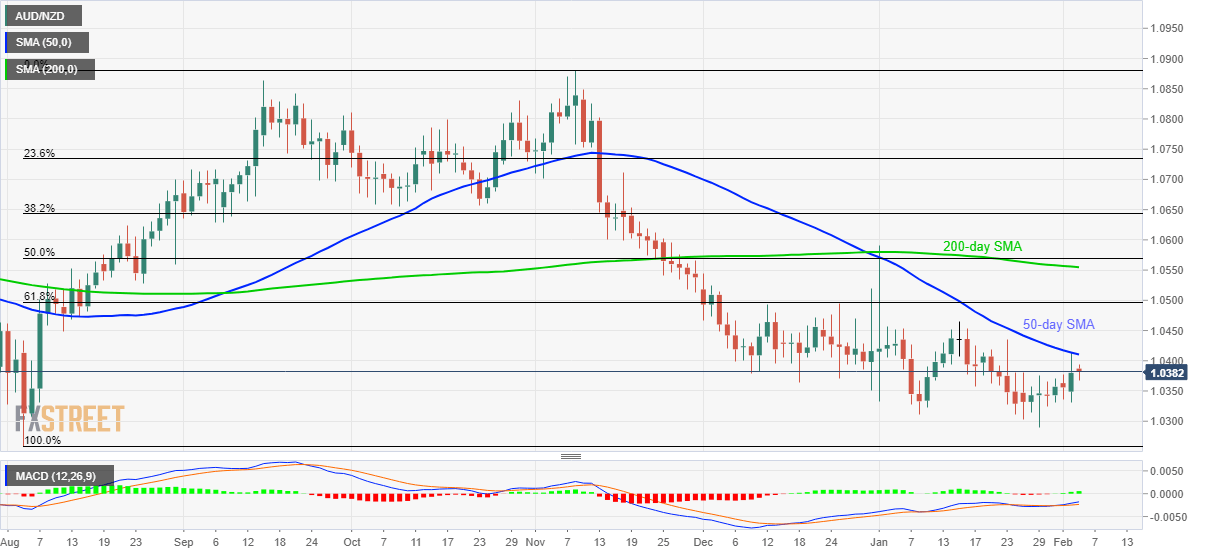

- 61.8% Fibonacci retracement adds to resistance.

AUD/NZD steps back to 1.0377 by the press time of early Wednesday morning in Asia. The pair recently paid attention to New Zealand’s fourth quarter (Q4) employment data that came in mixed. As a result, 50-day SMA holds its status as the immediate upside barrier despite the pair’s rise to challenge the same during the RBA-led rise the previous day.

Read: Breaking: A mixed New Zealand jobs report sends NZD to 0.65 the figure

Other than 50-day SMA level of 1.0410, the mid-January high surrounding 1.0465 and 61.8% Fibonacci retracement of the pair’s August-November 2019 upside, near 1.0500, also challenge the buyers.

Furthermore, 200-day SMA and 50% Fibonacci retracement, around 1.0555 and 1.0570 respectively, will keep a tab on the bulls beyond 1.0500.

Alternatively, 1.0310/300 area including lows marked on January 08 seems to be the near-term key support, a break of which could recall August 2019 lows near 1.0260 and the previous year bottom surrounding 1.0225.

It should, however, be noted that bullish MACD and the pair’s repeated failures to slip beneath 1.0300 shows the sellers’ exhaustion and a mild recovery.

AUD/NZD daily chart

Trend: Pullback expected