- AUD/NZD bears stay in control below fresh daily bearish structure.

- 4-hour support should be monitored at this juncture.

As per the prior analysis, AUD/NZD Price Analysis: Bears holding their ground, eyes on downside continuation, the bears are moving into gear to target the daily support structure as follows:

Prior analysis

”We have now seen the price break prior support as follows, which stands the bears in good stead for the opening sessions this week:”

”There could be a restest of the old support that would be expected to act now as resistance.

From a 4-hour perspective, the M-formation could be anticipated to pull in a bid to test the neckline resistance and 21-EMA confluence as follows:”

Live market analysis

The price retested the old support as illustrated in the above chart before moving a touch lower.

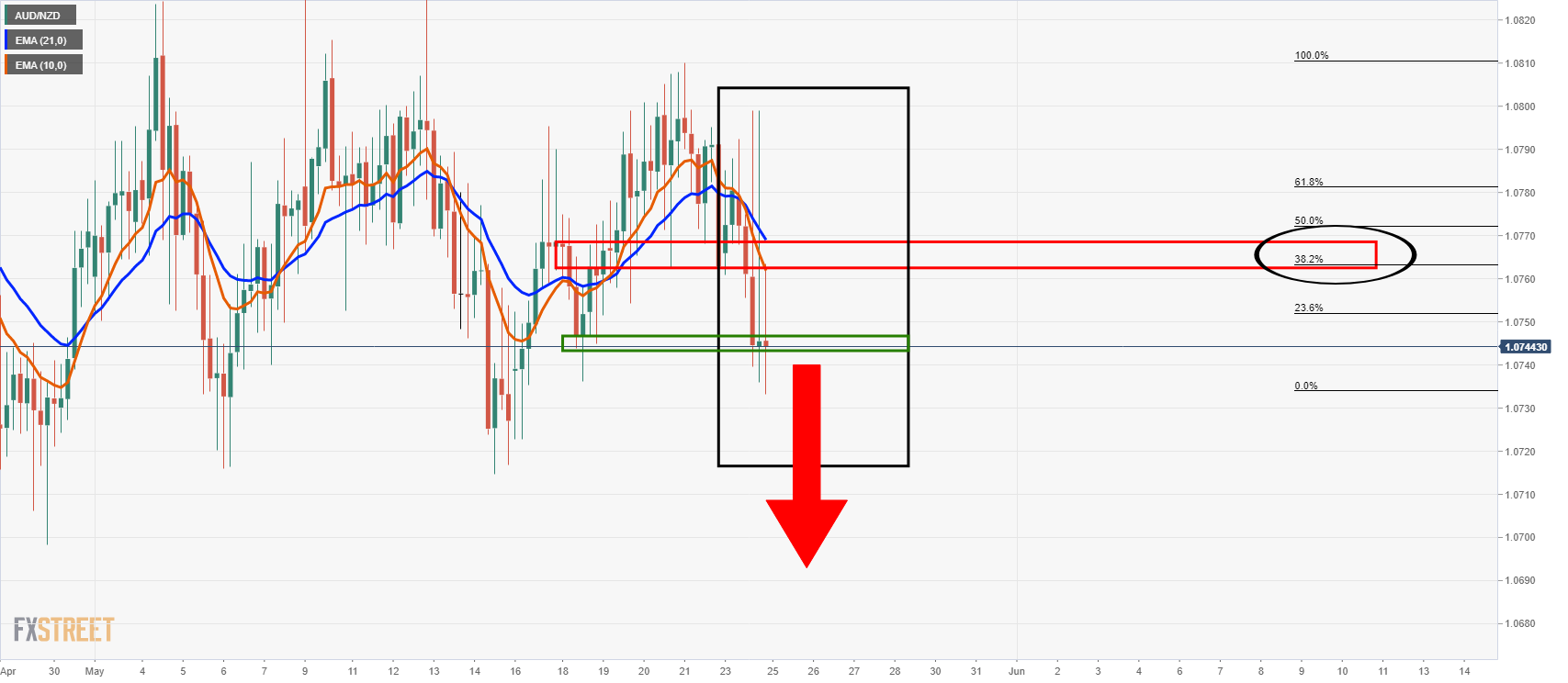

The price is now below new daily bearish structure which includes the confluence of the 21-EMA and the 38.2% Fibonacci retracement of the bearish impulse.

From a 4-hour perspective, this gives a vantage point from where to assess the bearish environment for additional conviction as follows:

The bears are being held up at meanwhile support but the price trades below the bearish 21 and 10 EMA crossover and daily resistance.

A break below support will add more conviction to the bearish bias.