- AUD/NZD fizzles RBNZ-led uptick to keep two-week-old support break.

- RBNZ kept monetary policy unchanged but flashed mixed signals on economics.

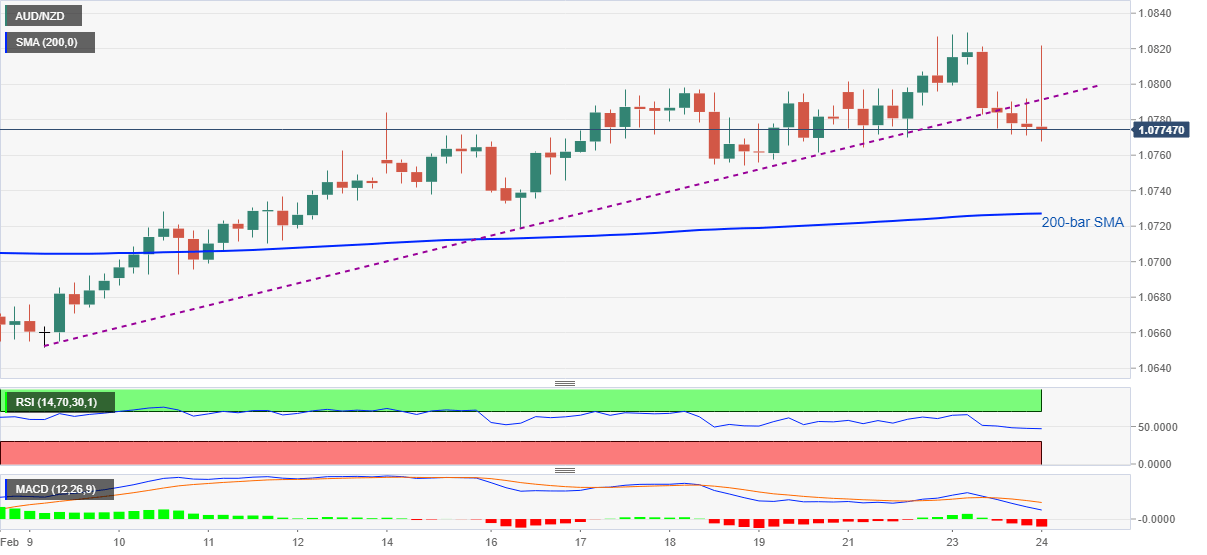

- Bearish MACD also favors sellers targeting 200-bar SMA.

- Bulls need to refresh yearly high above 1.0830 to retake control.

Following its initial run-up to 1.0821, AUD/NZD drops back to 1.0773 during early Wednesday. The pair’s latest moves could be traced to the Reserve Bank of New Zealand’s (RBNZ) quarterly monetary policy meeting results.

Read: Breaking: RBNZ keeps QE, OCR unchanged

Given the pair’s sustained trading below the previous support line from February 09, amid bearish MACD, AUD/NZD sellers are determined to attack the 200-bar SMA level of 1.0727.

It should, however, be noted that the quote’s weakness past-1.0727 will not hesitate to challenge the monthly bottom surrounding 1.0540.

Meanwhile, corrective pullback beyond the previous support line, at 1.0790 now, needs to cross the latest high, also the highest since January 20, 2021, around 1.0845, to convince traders.

Following that, October 2020 high near 1.0910 and the 1.10000 threshold will be in the spotlight.

AUD/NZD four-hour chart

Trend: Further weakness expected