- AUD/NZD is basing on a weekly support structure and RBA cut projections have been set back to later in the year.

- Dovish tilt at the Fed should give a potentially oversold AUD some support.

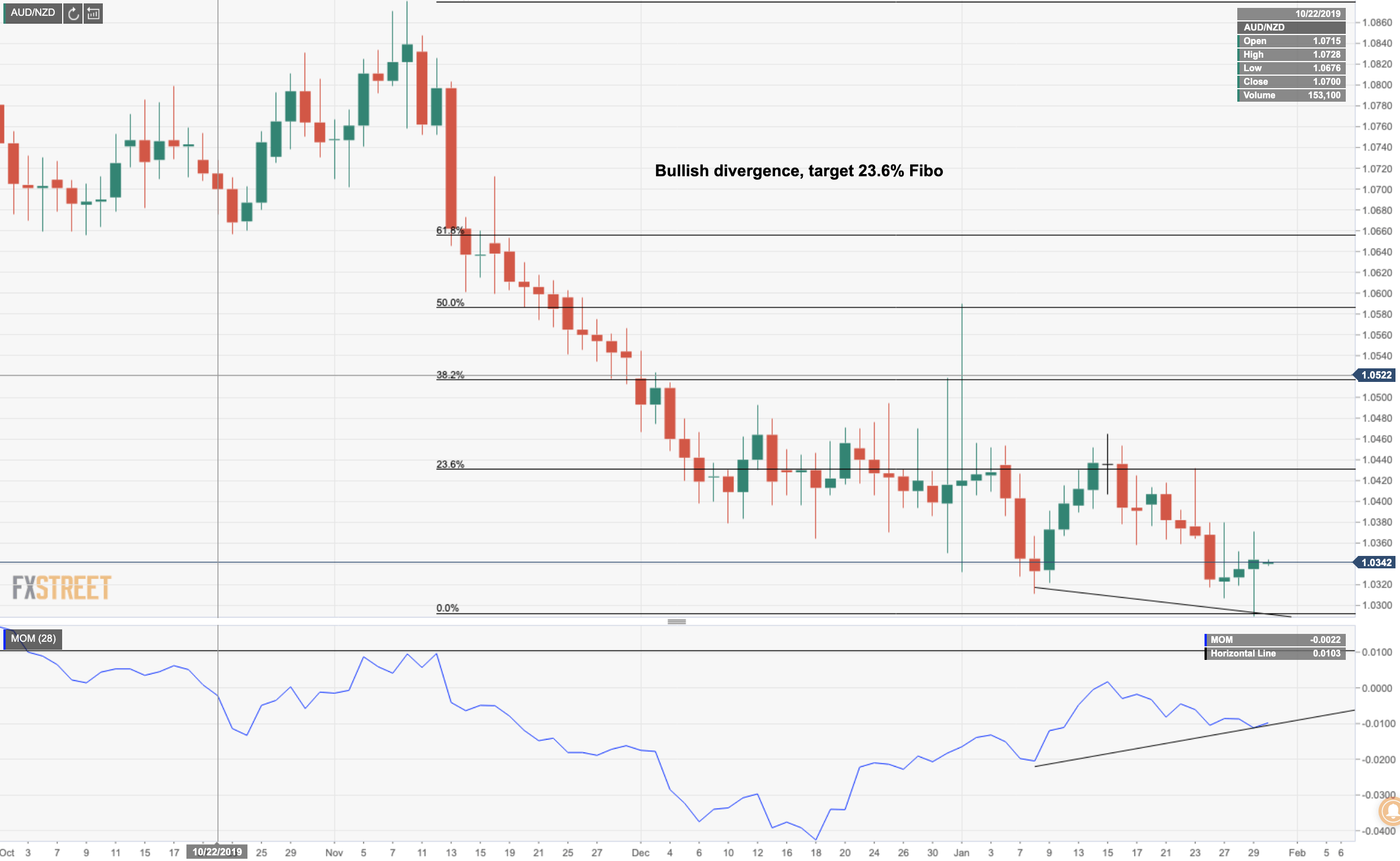

- Bullish divergence supports upside bias.

AUD/NZD has been recovering from a major support structure and targets a run towards a 23.6% Fibonacci retracement of the daily highs (buy stop liquidity). A 60-day count back marks a key momentum target for a stronger bullish divergence buy-signal for a prolonged bullish correction towards a 38.2% Fibo target at 1.0523.

Overnight, the Federal Reserve left rates on hold although US Yields dropped to a low of 1.587%, down 5.4 basis points (bps), by the end of their Wednesday’s session. A lower for the longer environment should b supportive of a bullish yield spread for AUD on dialled back prospects of a rate cut as soon as Feb. 4th from the RBA.

Related links

-

National Australia Bank pushes back RBA rate cut call

-

Technical tweaks and dovish squeaks – Rabobank

-

US 10-year treasury yields refresh 16-week low as risk-tone heavies