- AUD/NZD stretches losses from 1.0656 to ignore the previous day’s recovery.

- The 1.0600 round-figures can offer intermediate halt ahead of the triangle’s support.

- 200-bar SMA adds strength to the upside barriers.

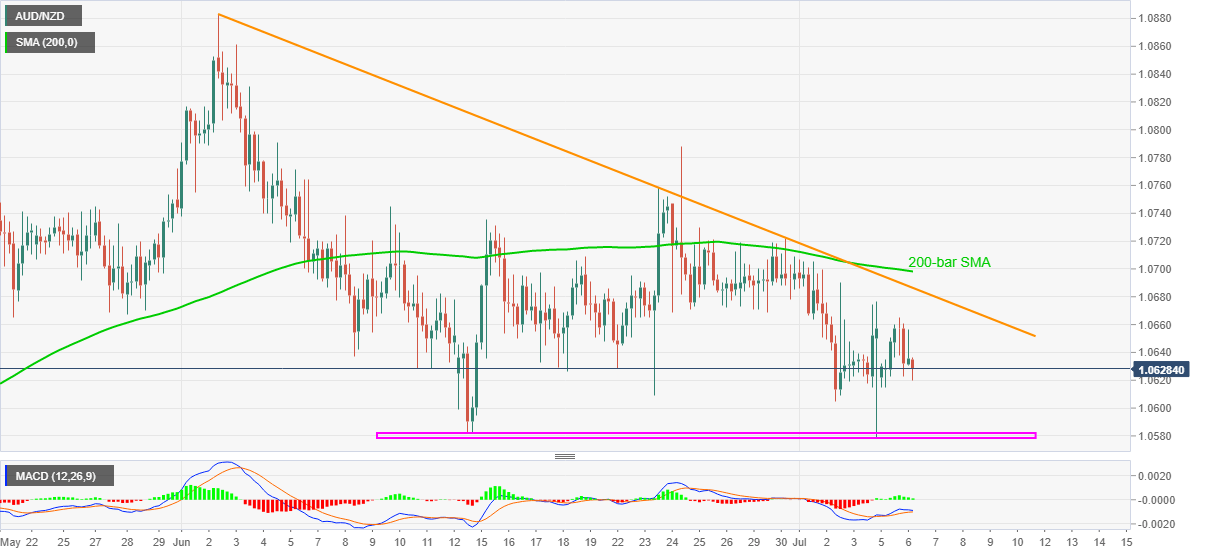

AUD/NZD prints 0.10% loss while declining to 1.0630 during Tuesday’s Asian session. Even so, the pair remains inside the monthly descending triangle formation, currently attacking the bottom. The pair traders are likely waiting for the Reserve Bank of Australia’s (RBA) monetary policy decision, up for publishing at 04:30 GMT, for fresh impulse.

Read: Reserve Bank of Australia Preview: Policymakers to remain cautiously optimistic

Considering the no rate change expectations from the RBA, coupled with likely upbeat tone based on the Australian dollar’s latest strength, the AUD/NZD prices may recover from the current levels.

Though, resistance line of the mentioned triangle, at 1.0690 now, followed by a 200-bar SMA level of 1.0700, could challenge the bulls afterward.

If at all the RBA’s anticipated optimism propels the quote beyond 1.0700, the June 24 uptick near 1.0790 and the previous month’s high near 1.0885 could lure the bulls.

On the downside, the pattern’s support line around 1.0580/75 is likely to restrict the pair’s near-term declines. However, a clear break of 1.0575 will extend the south-run towards the late-April low near 1.0470.

AUD/NZD four-hour chart

Trend: Sideways