- AUD/NZD refreshes weekly low on better-than-expected New Zealand CPI data.

- MACD turns bearish, sustained trading below 200-HMA favor sellers.

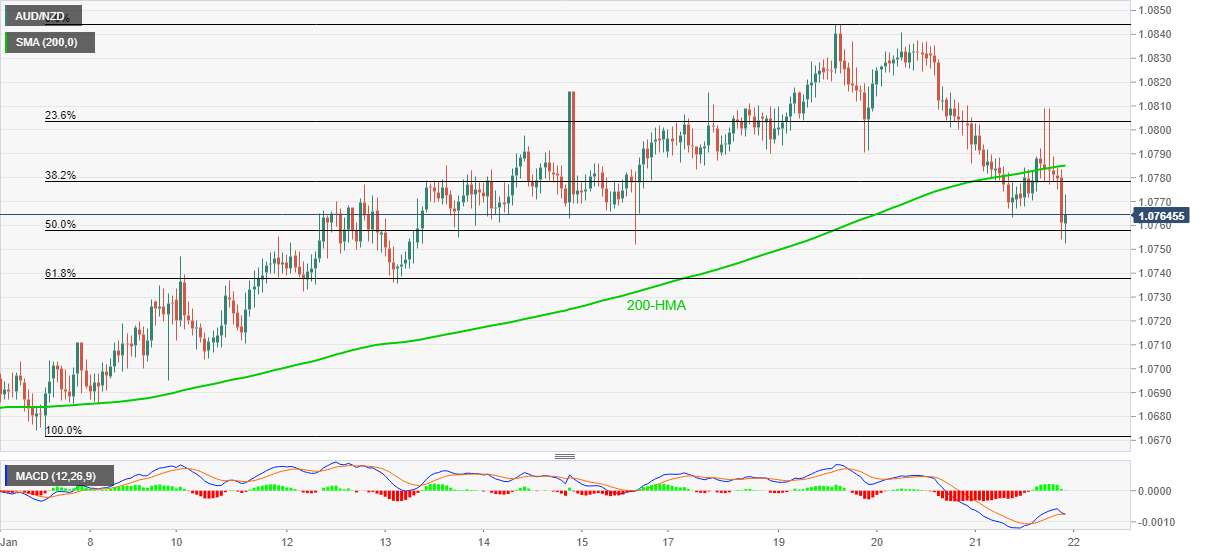

AUD/NZD takes offers near 1.0755 while rewriting the weekly low during the initial Asian trading on Friday. The quote recently declined after New Zealand (NZ) published fourth quarter (Q4) Consumer Price Index (CPI) data. Also favoring the sellers could be the pair’s sustained trading below 200-HMA and bearish MACD.

NZ CPI jumped above 0.0% forecast to 0.5% QoQ while also printing 1.4% YoY figures versus 1.1% market consensus. As the key inflation figures ease pressure from the RBNZ to recheck their cautious optimism, the New Zealand dollar (NZD) responds with a jump in prices following the release.

Read: NZ CPI: 1.4% YoY 0.5% QoQ, beats expectations, NZD/USD bid

Technically, the quote stretched its U-turn from 200-HMA and breaks 50% Fibonacci retracement of January 07-19 upside, which in turn directs the sellers to a 61.8% Fibonacci retracement level of 1.0737.

Should bears refrain from bouncing off the key Fibonacci retracement support, the 1.07000 threshold will flash on their radars.

Meanwhile, an upside clearance of 200-HMA, at 1.0785 now, will recall the 1.0800 round-figure on the chart. However, multiple upside barriers around 1.0835/40 will challenge AUD/NZD bulls afterward.

AUD/NZD hourly chart

Trend: Bearish