- AUD/NZD probes the monthly resistance line after RBA’s no rate change.

- 50-day SMA adds to the upside barriers.

- A three-week-old rising trend line offers additional support.

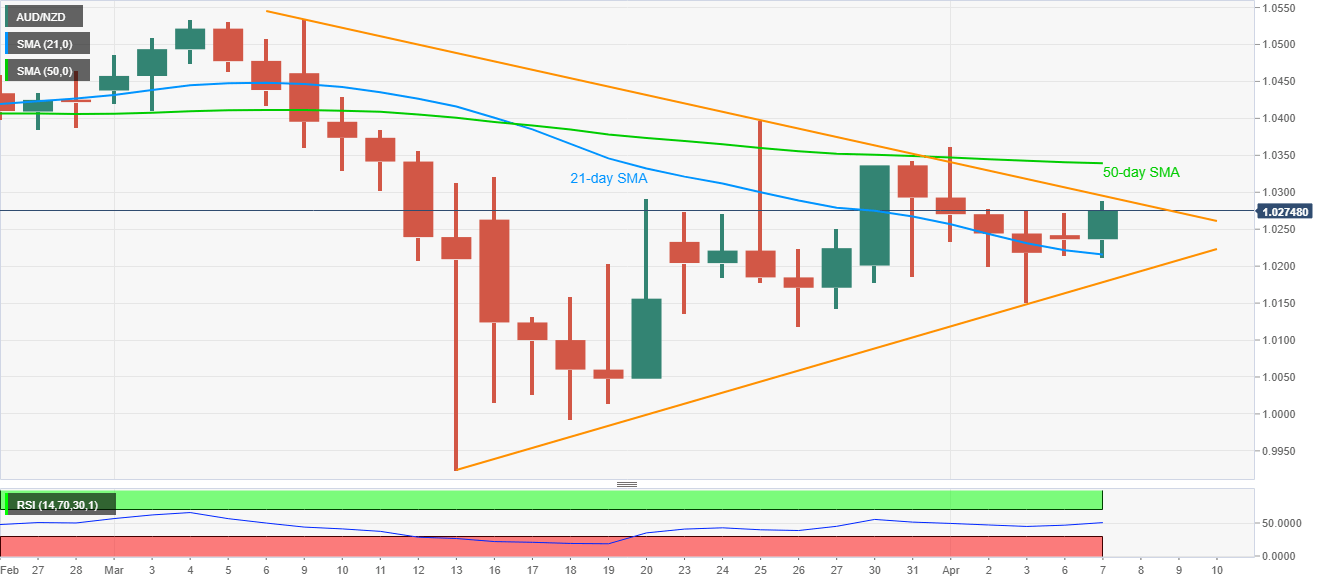

Following the RBA’s no rate change announcement, not to forget upbeat remarks, AUD/NZD extends recovery gains from 21-day SMA to a one-week high of 1.0289, currently near 1.0277, amid the early Tuesday.

The pair currently confronts the short-term rising trend line, at 1.0295, ahead of targeting a 50-day SMA level of 1.0340.

However, the pair’s sustained trading beyond 1.0340 will enable it to question March month top surrounding 1.0535.

Meanwhile, a daily closing below 21-day SMA level of 1.0215 can drag the quote to the near-term rising support line, currently at 1.0175.

AUD/NZD daily chart

Trend: Further recovery expected