- Australian dollar retreats after being rejected from above 1.0800.

- The 1.0850 area is again a critical resistance for AUD/NZD.

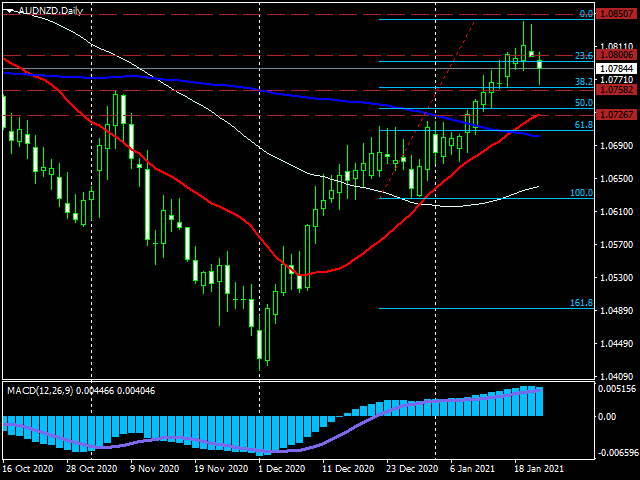

The AUD/NZD hit the highest level in three months on Tuesday at 1.0841. It later failed to hold above 1.0800 and started to correct lower. The retreat continued until the 1.0760/65 zone, also the 38.2% Fibonacci retracement of the last leg higher.

The rally run into a strong resistance at the 1.0850 area. A consolidation above is needed to clear the way to more gains, probably targeting 1.0900. The trend remains bullish but in the short-term, the rejection from 1.0800 and the retreat shows some difficulties ahead. The rebound from an uptrend line at 1.0760 shows the Aussie still has some momentum and could test levels above 1.0800 in the short-term. The key for aussie is to hold above 1.0800.

A slide below 1.0760 would point to further weakness in AUD/NZD but not to a change in the trend. Key support stands at 1.0700/10. The rally may not be over, but for it to continue at the current speed, a rebound back above 1.0800 over the next sessions is a must.

AUD/NZD daily chart