- AUD/NZD rises to eight-day high despite RBA matching wide market expectations.

- A five-week-old falling trend line will keep buyers in check.

- Sellers may look towards last week’s low on the U-turn.

AUD/NZD is up +0.40% to 1.0390 after the RBA matched most consensus while announcing no change in the benchmark interest rate of 0.75% during early Tuesday. Traders might have given considerations to the statement that term coronavirus, Aussie bushfires as temporary pain.

Read: RBA: Bushfires, coronavirus will temporarily weigh on growth

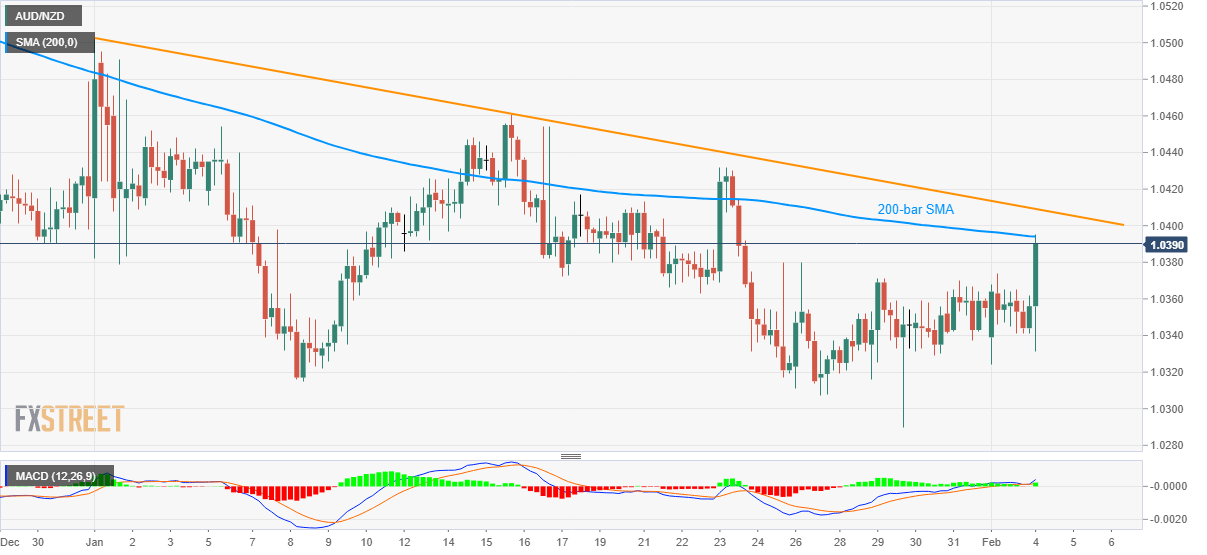

In a reaction, the quote rises to a 200-bar SMA level of 1.0394, not to mention the highest since January 23. However, the quote is still below the short-term falling trend line, at 1.0410, which keeps buyers away.

Should AUD/NZD prices manage to cross the 1.0410 mark, the mid-January tops near 1.0460 and the previous month high near 1.0500 will be on the bull’s radar.

Meanwhile, 1.0340 and last week’s low near 1.0300 could entertain sellers.

However, pair’s declines below 1.0300 might not hesitate to recall the August 2019 low near 1.0260.

AUD/NZD four-hour chart

Trend: Pullback expected