- AUD/NZD recovers from short-term support following RBA’s 0.25% rate cut.

- 200-day SMA acts as the key upside barrier.

- Multiple lows around 1.0310 offer strong downside support.

Following the RBA’s 0.25% rate cut to the record-low interest rate of 0.50%, AUD/NZD rises to 1.0457 amid early trading hours of Tuesday. Even so, the pair remains below a downward sloping trend line since early January.

Read: Breaking: RBA cuts Official Cash Rate by 25 bps to 0.50%, AUD/USD jumps

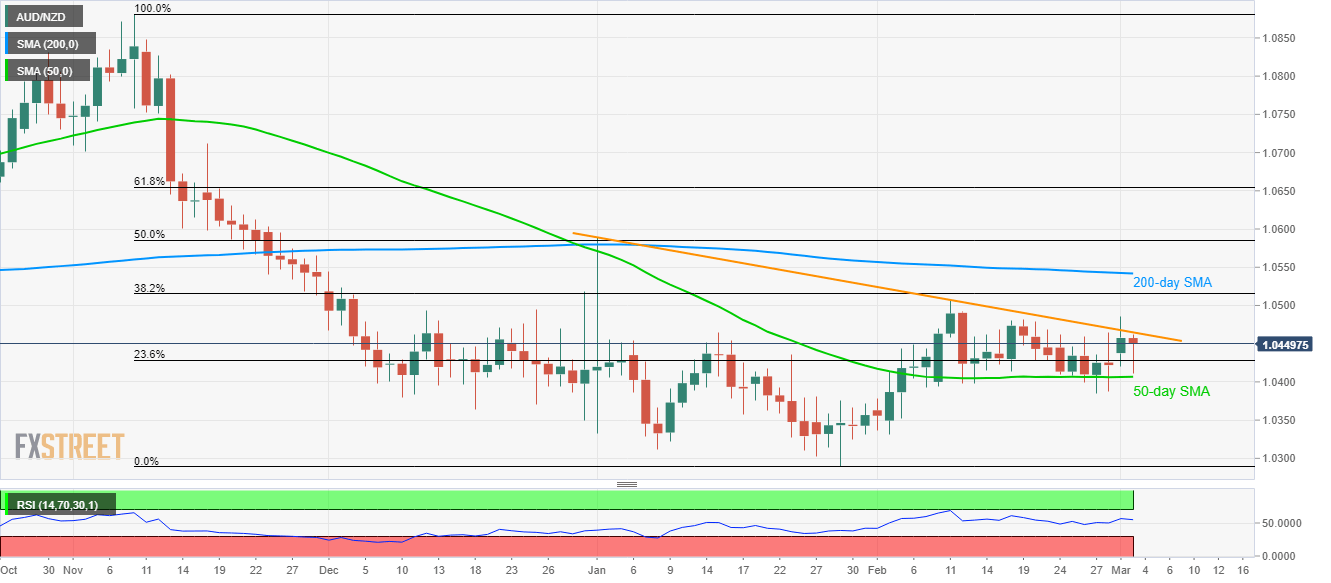

Given the pair’s sustained trading beyond 50-day SMA, prices are likely to cross the immediate trend line resistance, at 1.0465 now, which in turn will propel AUD/NZD prices towards 38.2% Fibonacci retracement of its November 2019 to January 2020 fall, near 1.0515.

However, a 200-day SMA level around 1.0545 will question the bulls afterward, failing to which can escalate the recovery moves towards 50% and 61.8% Fibonacci retracement levels near 1.0585 and 1.0655 respectively.

Meanwhile, a daily closing below 50-day SMA level of 1.0405 will need validation from a downtick below 1.0400 to push the sellers towards 1.0380 support level.

Should there be further declines below 1.0380, multiple lows marked from the early January, around 1.0310, will please the bears.

AUD/NZD daily chart

Trend: Sideways