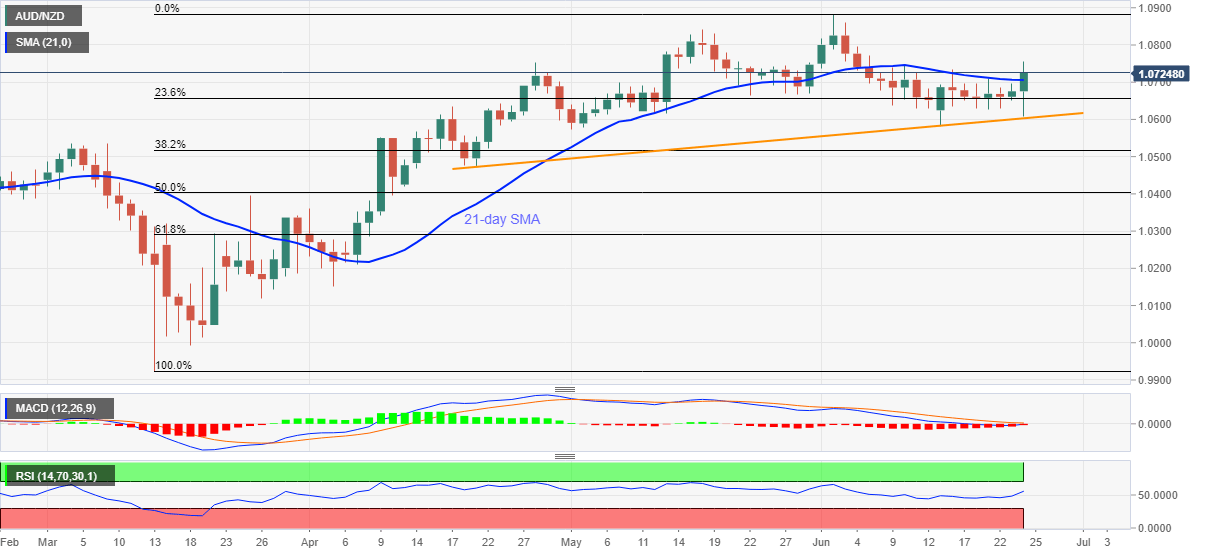

- AUD/NZD breaks above 21-day SMA as RBNZ left monetary policy unchanged.

- May month high on the bulls’ radars ahead of the monthly peak.

- A two-month-old rising trend line can offer key support.

- Buyers remain hopeful as MACD teases bulls, RSI stays normal.

AUD/NZD takes the bids near 1.0730, intraday high of 1.0756, during the early Wednesday’s trading. The pair recently rallied to the highest levels since June 05 as the RBNZ refrained from any action but showed readiness to ease monetary policy further during the latest meeting.

Read: RBNZ leaves monetary policy settings unchanged, Kiwi unfazed around 0.65

The fundamental weakness of the New Zealand dollar also gains support from a technical breakout of 21-day SMA amid mostly upbeat MACD and RSI conditions.

As a result, the buyers can accelerate the recovery moves from short-term support line towards challenging the May month top near 1.0840. However, 1.0800 round-figure might offer an intermediate during the rise.

Meanwhile, the pair’s fails to stay beyond a 21-day SMA level of 1.0706 may revisit the upward sloping trend line from April 21, near 1.0600. Though, any further weakness below 1.0600 might not hesitate to challenge April 20 bottom surrounding 1.0475.

It should also be noted that the quote’s declines below 1.0475 will aim for March 25 peak close to 1.0400.

AUD/NZD daily chart

Trend: Bullish