- AUD/NZD fails to sustain near-term support-line break as Australia data favors buyers.

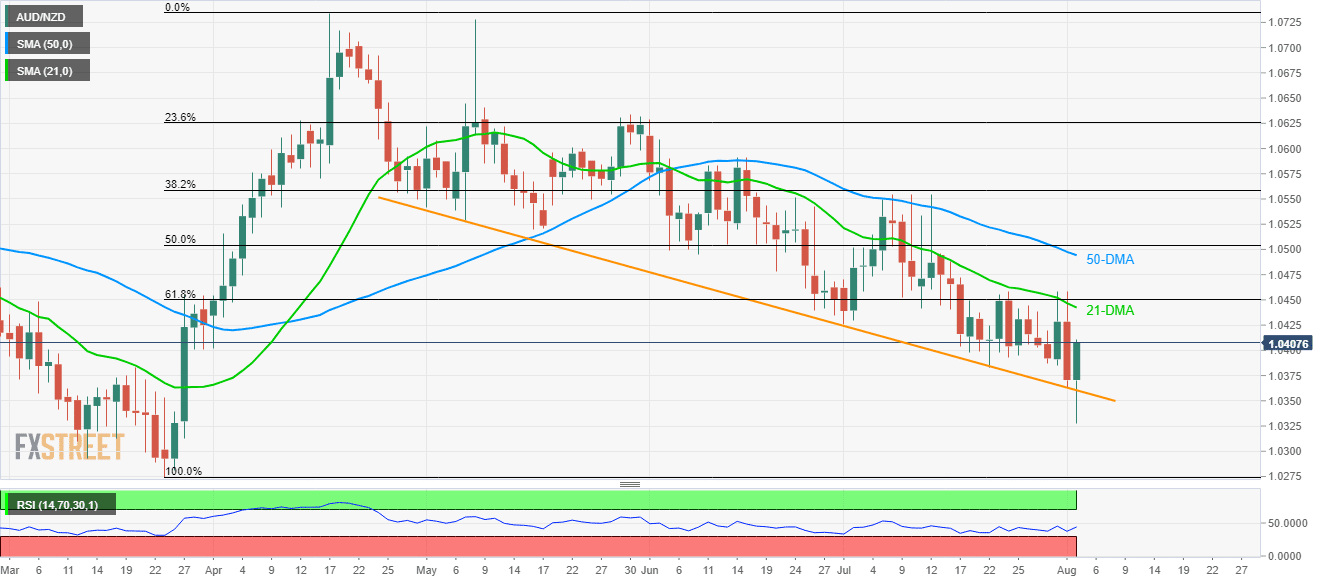

- 21-DMA, 61.8% Fibonacci retracement seem nearby resistances to watch.

Having witnessed better than forecast Retail Sales numbers from Australia, AUD/NZD rises to 1.0400 during early Friday.

The quote regained its status above a downward sloping trend-line since early-May, which in turn keeps its declines limited around 1.0360.

With this, prices may again target 21-day moving average (DMA) at 1.0442 ahead of confronting 61.8% Fibonacci retracement of March-April upside around 1.0450.

If at all pair manages to rise past-1.0450, late-July tops around 1.0450 and 50-DMA level of 1.0495 could please the bulls.

On the downside break of 1.0360, 1.0310 and March month low near 1.0275 can well flash on bears’ radar.

AUD/NZD daily chart

Trend: Pullback expected