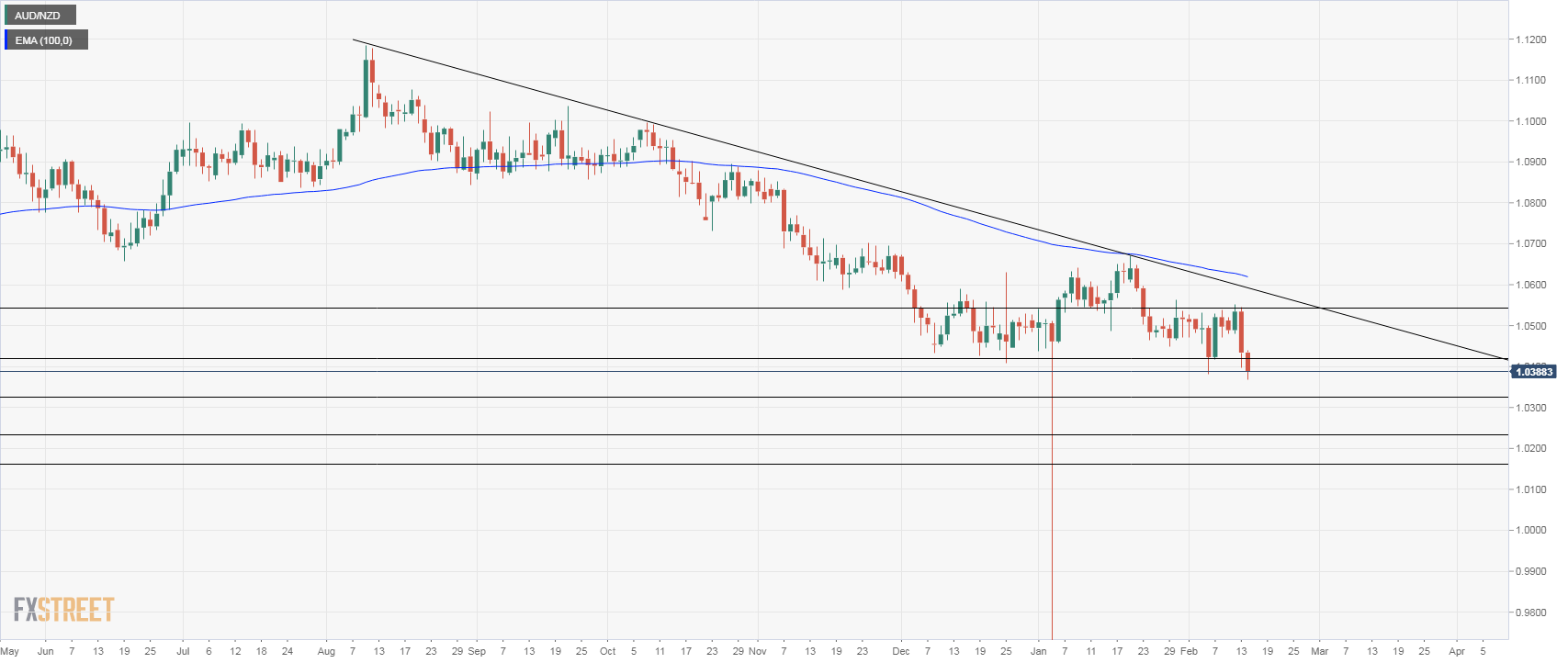

- The Australian dollar dropped sharply against the Kiwi, falling firmly below January and December lows. The consolidation under the 1.0400 area leaves the pair vulnerable to more losses over the next days.

- The next target to the downside could be seen at 1.0320; below a strong resistance is seen at 1.0235.

- A recovery back above 1.0420 would ease the negative tone. The two key levels to watch are 1.0550 (horizontal) and 1.0590 (downtrend line). A close above 1.0600 would strengthen the case for a recovery.

AUD/NZD Daily chart

AUD/NZD

Overview:

Today Last Price: 1.0387

Today Daily change: -0.0047 pips

Today Daily change %: -0.45%

Today Daily Open: 1.0434

Trends:

Daily SMA20: 1.0519

Daily SMA50: 1.052

Daily SMA100: 1.0651

Daily SMA200: 1.0775

Levels:

Previous Daily High: 1.0545

Previous Daily Low: 1.0396

Previous Weekly High: 1.0538

Previous Weekly Low: 1.0382

Previous Monthly High: 1.0671

Previous Monthly Low: 0.9631

Daily Fibonacci 38.2%: 1.0453

Daily Fibonacci 61.8%: 1.0488

Daily Pivot Point S1: 1.0372

Daily Pivot Point S2: 1.031

Daily Pivot Point S3: 1.0223

Daily Pivot Point R1: 1.052

Daily Pivot Point R2: 1.0607

Daily Pivot Point R3: 1.0669