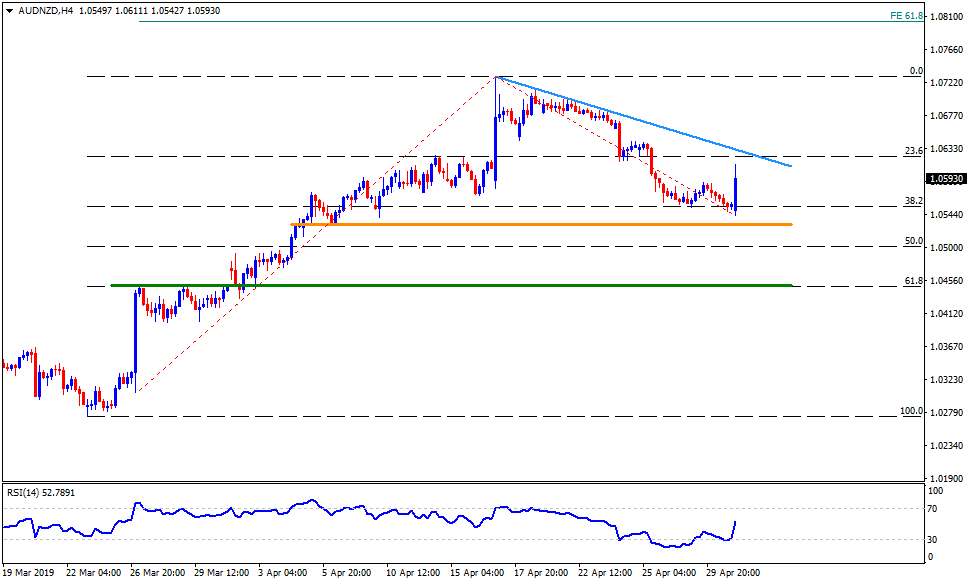

- The quote took a U-turn from 1.0555 on weak NZ employment data.

- A fortnight old descending trend-line is in the spotlight for now.

AUD/NZD is trading near 1.0600 after rising to the intra-day high of 1.0615 on sluggish quarterly employment data from New Zealand.

38.2% Fibonacci retracement of March to April upside, at 1.0555, has offered frequent bounces to the quote off-late, which in turn shifts market attention to a downward sloping resistance-line since April 17, at 1.0635 now.

In a case where buyers keep dominating sentiment past-1.0635, 1.0680, 1.0710 and a recent high around 1.0730 can act as buffers during its rally to 61.8% Fibonacci expansion (FE) of recent moves, at 1.0800.

On the downside break beneath 1.0555, 1.0530, 1.0490 and horizontal support adjacent to 61.8% Fibonacci retracement at 1.0450 seem crucial for sellers.

Should there be increase selling pressure under 1.0450, 1.0400 and 1.0670 could become bears’ favorites.

AUD/NZD 4-Hour chart

Trend: Positive