AUD/NZD is on bids around 1.0340 during early Asian sessions on Thursday.

The quote recently bounced off 1.0297 low as eight-year low of 4.9% Australian unemployment rate grabbed more market attention than softer employment change figure of 4.6K versus 14.0K expected and 39.1K prior.

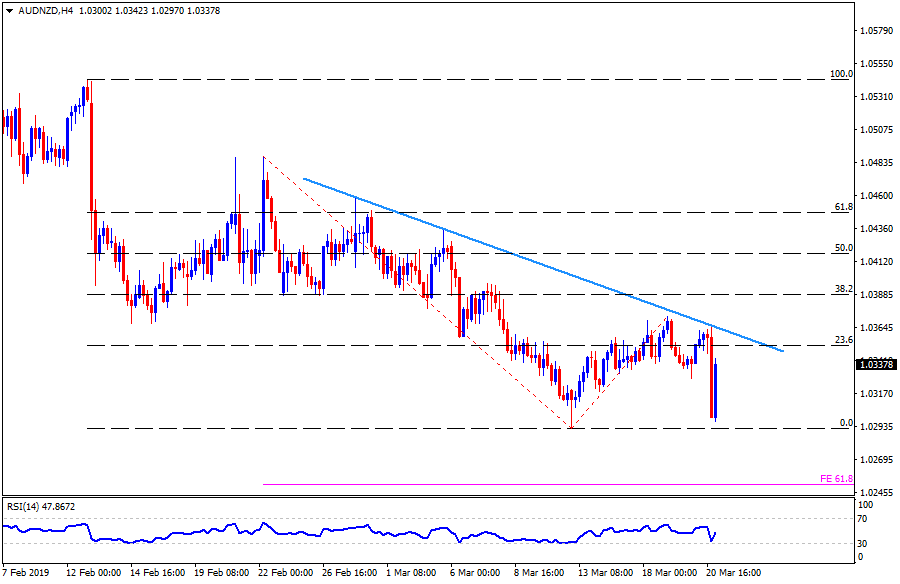

While oversold levels of 14-bar relative strength index (RSI) and upbeat jobs report helped the pair to reverse from day’s low, three-week long descending resistance-line and mid-February lows can confine latest advances around 1.0365/70.

Given the price rise beyond 1.0370, 38.2% Fibonacci retracement of February – March declines, at 1.0390, followed by 1.0400, could please buyers.

Additionally, the pair’s successful trading above 1.0400 can further escalate the recovery towards 61.8% Fibonacci retracement level near 1.0450.

Alternatively, pair’s slip under 1.0297 may need to clear early-month low around 1.0290 in order to aim for 61.8% Fibonacci expansion (FE) level of 1.0250.

Also, September 2016 bottom around 1.0230 and mid-April 2015 support near 1.0220 can flash on bears’ radar past-1.0250.

AUD/NZD 4-Hour chart