- RBA’s quarterly SoMP cut near-term inflation and growth forecasts.

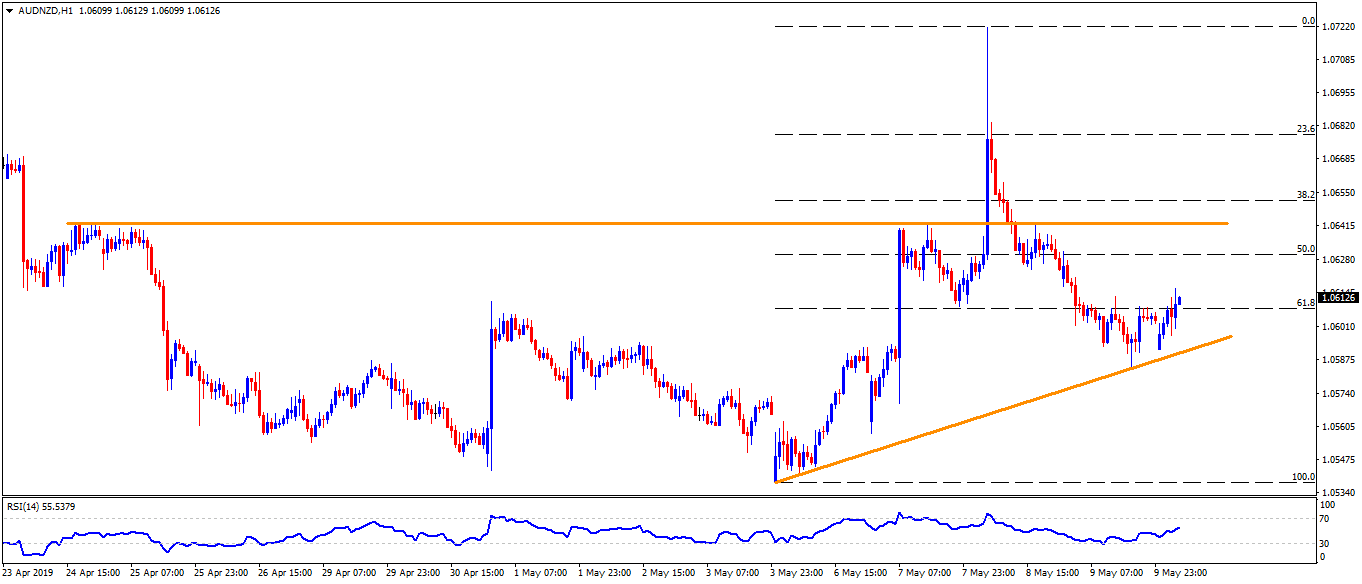

- Break of 61.8% Fibo. can propel the quote to multiple resistances near 1.0640/45.

AUD/NZD is on the bids near 1.0615 as markets gave upbeat reaction to the Reserve Bank of Australia’s (RBA) quarterly statement on monetary policy on early Friday.

The pair recently crossed 61.8% Fibonacci retracement of its current week’s upside and is likely aiming for 1.0640/45 horizontal-area comprising multiple highs marked since April 24.

Though, 1.0625 can offer immediate resistance to the pair.

Also, pair’s sustained upside past-1.0645 enables buyers to aim for 1.0665, 1.0685 and 1.0725 during the additional rise.

Meanwhile, immediate upward sloping trend-line at 1.0590 acts as nearby support, a break of which can recall 1.0575 and 1.0555 levels on the chart.

In case prices slip below 1.0555, 1.0540 and 1.0500 could become bears’ favorites.

AUD/NZD hourly chart

Trend: Positive